By Chris Carey

Jim McNair and Kevin O’Connor contributed to this report

When financier Barry C. Honig was waging a proxy fight for control of the company that became Riot Blockchain Inc. (Nasdaq: RIOT), he demanded that it return excess capital to shareholders through a special dividend.

But once Honig and his allies took over, they did exactly the opposite. The Colorado-based company, then known as Bioptix Inc., raised an additional $7 million last spring through two private placements. Honig, his business partners and other associates bought nearly all of the stock, warrants and convertible notes sold in those deals, which were priced at a 30 percent discount to the market.

By the second week of October, they had turned those securities into 4.7 million common shares. That stock, combined with earlier purchases, gave them nearly two-thirds of the company, on a fully diluted basis.

Only then did Riot Blockchain pay the special dividend, distributing $1 per share or share equivalent, or a little less than $10 million. And in the six weeks that followed, the company’s stock price nearly tripled, as deals with two bitcoin-related businesses in which Honig and his associates had undisclosed stakes attracted investors who were seeking cryptocurrency plays. When Riot Blockchain’s stock hit $24 on the day after Thanksgiving, the shares issued through the April placement were worth more than $100 million.

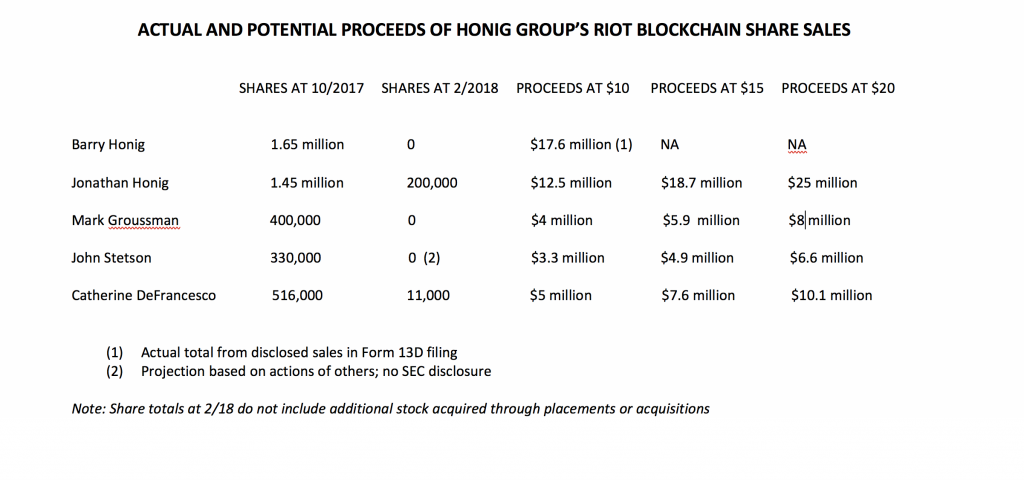

A Securities and Exchange Commission filing from April shows that Honig sold nearly all of his Riot Blockchain shares in October and November, collecting more than $17 million. He failed to promptly report those sales, as required under SEC rules for non-passive investors who own 5 percent or more of a company’s stock.

Our investigation found that three Honig associates – his brother, Jonathan Honig, and longtime partners Mark E. Groussman and John R. Stetson – likely sold more than $20 million of Riot Blockchain stock from October to January. Its shares peaked at $46.20 in December, then came crashing back to earth. They now trade for less than $4. The company is dangerously low on cash and the SEC is conducting a formal investigation.

As Sharesleuth reported in July, it appears that the group’s activities at Riot Blockchain, PolarityTE Inc. (Nasdaq: PTE, formerly Nasdaq: COOL) and Marathon Patent Group Inc. (Nasdaq; MARA) were part of a broader web of questionable dealings.

On Sept. 7, the SEC brought fraud charges against Barry Honig, Groussman, Stetson and 17 others individuals and entities, including John R. O’Rourke III, another longtime associate who was chairman and chief executive of Riot Blockchain.

The SEC alleged that the defendants participated in so-called “pump and dump” schemes at three other companies:

– BioZone Pharmaceuticals Inc., now Cocrystal Pharma Inc. (Nasdaq: COCP)

– MGT Capital Investments Inc. (OTC: MGTI)

– Mabvax Therapeutics Holdings Inc. (OTC: MBVX)

According to the SEC’s complaint, those schemes generated more than $27 million.

Stetson was, until Sept. 7, executive vice president and chief investment officer of PolarityTE, a Utah-based biotech company whose predecessor was headed by Honig. Our investigation found that the Honig group’s actions at PolarityTE and before that, Majesco Entertainment Inc., mirrored their moves at Riot Blockchain, right down to private placement-and-special dividend maneuver.

The SEC also brought charges against Dr. Phillip Frost, the billionaire chairman and chief executive of Opko Health Inc. (Nasdaq: OPK), and against Opko itself. It alleged that Frost and Opko were part of an undisclosed “control group” at BioZone and Mabvax, and that they either participated in the group’s wrongful activities or aided and abetted them.

Our analysis of SEC filings showed that Honig and Frost sold more than $20 million of their PolarityTE stock between February 2017 and February 2018, with most of those sales coming in the second half of last year.

Once again, Honig failed to promptly report his sales, as required under SEC rules.

PolarityTE’s stock rose sharply this spring, going from $18.13 a share at the start of April to a high of $41.22 in late June. During that period, the company raised $88 million in new capital through a pair of stock offerings.

At its peak, PolarityTE had a market capitalization of almost $900 million. The company’s stock has since fallen by almost half, closing at $21.12 on Sept. 25.

PolarityTE’s most recent proxy filing shows that Honig, Frost, Groussman, Stetson and another defendant in the SEC case – Michael H. Brauser – controlled as many as 4.95 million shares as of mid-August.

That stock would have had a market value of $126 million at the time. Even with the decline in the company’s share over the past few months, PolarityTE has the potential to be the Honig group’s biggest score – one that was years in the making.

(Editor’s note: Chris Carey, editor of Sharesleuth.com, does not invest in individual stocks and has no position in any of the companies mentioned in this report. Mark Cuban, owners of Sharesleuth.com, has short positions in the shares of PolarityTE and Opko.)

COMMON OWNERS, COMMON STRATEGIES

One of the unifying themes of the SEC’s fraud case against Honig and his associates is that they functioned as a unit, and that they exerted control over the companies and their management by virtue of their combined shareholdings and the infusions of cash they provided. Our investigation found that the Honig group’s involvement in Riot Blockchain and PolarityTE fit that same pattern. SEC filings and Canadian regulatory filings show that:

– From April 2017 to October 2017– just before the surge in Riot Blockchain’s stock price — Barry Honig, Jonathan Honig, Groussman and Stetson controlled roughly a third of its outstanding common shares. SEC filings show that another Honig associate, Catherine J. DeFrancesco, owned an additional 11 percent at the start of that period.

– As recently as February, Barry Honig, Groussman, Frost and Brauser held nearly 35 percent of PolarityTE’s outstanding common shares. Stetson, who was an officer and director, was listed as owning an additional 7 percent.

– Certain supposedly independent board members at both companies had undisclosed ties to Honig and his associates. For example, PolarityTE directors Steve Gorlin and Jon Mogford also were board members at Medovex Corp. (Nasdaq: MDVX), a medical products company. Gorlin was Medovex’s founder and former chairman. SEC filings show that Honig, Stetson, Groussman and O’Rourke provided funding to Medovex through stock placements in 2016 and 2017, and once held as much as 15 percent of its shares.

– Riot Blockchain director Andrew J. Kaplan was on the board of Majesco Entertainment when Honig was chief executive. He also is a director of U.S. Gold Corp. (Nasdaq: USAU), another company in which Honig, Stetson and Groussman were major investors. A second supposedly independent director (now ex-director), was the chief legal and development officer at MUNDOmedia Ltd., a digital advertising company in which Honig, O’Rourke, Stetson and Groussman had stakes. That director, Eric So, also a director of Therapix Biosciences Ltd. (Nasdaq: TRPX), an Israeli company that listed on the Nasdaq last year. Stetson was Therapix’s top U.S. shareholder; Groussman was a board member.

– Even Riot Blockchain’s plan to monetize its majority stake in a blockchain-based payment service called Tess Inc. runs through Honig. A recent Canadian securities filing shows that he was the intermediary who introduced O’Rourke to Lee Ann Wolfin, the head of Cresval Capital Corp. (OTC: CVLCF), a mining company into which Tess is planning to merge. Her late father, Arthur Wolfin, was Cresval Capital’s founder and chief executive. He also headed Levon Resources Ltd. (OTC: LVNVF), another mining company that did deals with two other companies whose shareholders included Honig, Frost, Stetson, O’Rourke, Brauser and Groussman. Levon owned a large chunk of Pershing Gold Corp. (Nasdaq: PGLC), and also did a reverse merger with SciVac Therapeutics Inc. (now part of VBI Vaccines (Nasdaq: VBIV), a third company backed by Honig, Frost and Opko.)

– Honig, O’Rourke, Catherine DeFrancesco and her husband, Andrew DeFrancesco, provided financing to Cool Holdings Inc. (Nasdaq: AWSM) and helped it go public through a reverse merger with InfoSonics Corp. earlier this year. Cool Holdings’ stock skyrocketed in the past two weeks, shooting from less than $5 to more than $20. That move was aided by a paid promotional campaign that called attention to the company’s connection to Apple Inc. (as an authorized reseller), and claimed the cash-strapped company was planning to expand from 17 stores to 200 by 2021. Its shares have fallen back below $10, in part because of reports questioning the accuracy of the postings.

THE REACTION TO THE SEC CHARGES

O’Rourke resigned from Riot Blockchain after the SEC charged him with fraud. Stetson was fired by PolarityTE within hours of the charges becoming public. Its chief executive, Dr. Denver Lough, said in a conference call on Sept. 12 that none of the other defendants had any “recent management, employment or consulting relationship” with that company.

Lough said PolarityTE had no involvement in, or knowledge of, the activities described in the complaint. He add that the company not heard from the SEC and was not the subject of any SEC investigation. Even so, we found other parallels to the alleged pump-and-dump schemes that Honig and the other were said to have orchestrated.

The SEC said that O’Rourke helped facilitate the group’s manipulative trading of Mabvax shares by touting the company in story posted at SeekingAlpha.com, under the pseudonym “Wall Street Advisors.’’ The article was headlined “Opko Spots Another Overlooked Opportunity in Mabvax Therapeutics,” and claimed that Opko had a strong track record of identifying undervalued companies and later monetizing its stakes in them.

A previous Sharesleuth investigation found that a small army of writers, both real and imaginary, contributed nearly 600 bullish articles about Honig-backed companies to various financial sites over the past six years. The list of featured companies included BioZone, MGT and Mabvax, We found that certain writers in the stealth-promotion network also produced a dozen favorable stories about PolarityTE and Riot Blockchain last year, some just before their shares skyrocketed. (see examples here, here and here ).

The stealth network also produced numerous stories touting or defending Opko, especially after it came under scrutiny from short sellers in 2013 and 2014.

MORE PARALLELS BETWEEN POLARITYTE AND RIOT BLOCKCHAIN

We also found that Honig and his associates used the same private placement-and-special dividend maneuver at Majesco as they did at Riot Blockchain.

Majesco, which produced and distributed video games, raised $11 million through two stock placements, in late 2014 and early 2015. Our analysis of SEC filings show that Honig, Brauser, Groussman and Frost got more than 80 percent of the nearly 2.2 million common or preferred shares issued in connection with those financings (adjusted for a subsequent reverse split). They also got warrants to buy another 2.2 million shares.

The warrants later were exchanged for roughly 1.2 million shares of common or convertible preferred stock, at no cost to the holders.

Majesco’s revenues fell by 80 percent in 2015, as its video-game business dried up. But the company never deployed the new capital in a bid to diversify or reverse its fortunes. Instead, it returned $10 million to shareholders through a special dividend in January 2016.

SEC filings show that $6 million of the dividend money went to holders of the preferred stock. That meant Honig, Brauser, Groussman and Frost got well over half of their original investment back AND got to keep their shares. They still held most of that stock in December 2016, when Majesco agreed to acquire PolarityTE.

That deal was completed in April 2017. When the combined company’s stock topped $30 last August, the common and preferred shares for which they paid roughly $9 million had a market value exceeding $100 million.

PolarityTE, by comparison, has generated just $432,000 in revenue over the past four quarters, and has recorded $52 million in losses.

The company filed a registration statement in late May covering the sale of 7.3 million shares held by current and former officers, directors, employees and consultants. Those shares had a market value of more than $187 million at the time. Many were subject to stock offering-related lockup provisions that prevented them from being sold until this month or next month. Even so, it appears that PolarityTE insiders could sell tens of millions worth of stock before the company records its first dollar of profit.

The registration listed 20 people besides Lough and Swanson who were offering to sell 50,000 shares or more, enough to generate more than $1 million each at the current market price. That list includes Matthew S. Swanson, the brother of PolarityTE’s co-founder and chief operating officer, Dr. Edward W. Swanson. Matthew Swanson is a member of Chimera Securites LLC, a New York-based securities firm that specializes in proprietary trading. His disclosure form with the Financial Industry Regulatory Authority shows that he also has worked for PolarityTE since December 2016.

That form does not list his position at PolarityTE, nor is it listed in any of PolarityTE’s SEC filings. One of those filings showed that he was granted options to buy 141,000 shares at $3.16 each. That is among the biggest stock awards the company has issued to anyone, including its top scientists. At the current share price, those options could be exercised and sold for a profit of more than $2.5 million.

QUESTIONS ABOUT TECHNOLOGY AND DUE DILIGENCE

Sharesleuth found that Majesco did not conduct a long or extensive search for a merger partner before it picked PolarityTE. Nor does it appear to have conducted extensive due diligence before offering to buy the company.

According to one account in a trade publication, the deal was born when Stetson, who was Majesco’s chief financial officer at the time, took a call from Swanson, a fraternity brother from their days at the University of Pennsylvania.

Swanson wanted Stetson’s thoughts on the pitch material PolarityTE had put together in its search for venture capital. Instead, Stetson told Swanson to put that effort on hold, saying that Frost might be interested in the company and its technology.

Another article, on Forbes.com, said that Honig and Frost presented a term sheet to PolarityTE’s founders within 24 hours of initiating discussions. Majesco agreed to issue preferred stock valued at $104 million to Swanson and Lough in return for their technology, which had no patent protection — just a pending application with the U.S. Patent and Trademark Office.

Government records show that the patent office issued a preliminary rejection of that application a few days before Majesco and PolarityTE completed their merger in 2017. Majesco did not disclose that prior to the closing.

The federal docket shows that the patent office also issued a “final rejection’’ notice by email on June 4 of this year, just before PolarityTE announced a $55 million stock offering. It did not disclose that development, either. The offering closed on June 7.

PolarityTE’s intellectual-property attorney said in a conference call in late June that the final rejection wasn’t really final, and that the company had up to 90 days to submit additional information in support of its application.

The docket shows that PolarityTE did just that on Sept. 13. However, it appears that the company narrowed the scope of its application, concentrating on some aspects of its technology and dropping claims on others.

Other analysis pieces about PolarityTE have questioned whether it has clear rights to its technology. They asserted that Swanson and Lough developed their techniques at least partly through research at Southern Illinois University and Johns Hopkins University. If that is true, those institutions could seek partial ownership, or royalties.

Johns Hopkins, where Lough and Swanson were plastic-surgery residents prior to launching PolarityTE, did not respond to our questions about their intellectual property policies.

Other skeptical articles about PolarityTE have warned that its reliance on certain FDA rules that currently allow it to avoid the need for pre-market regulatory approval might be misplaced. That analysis concluded that PolarityTE’s techniques appear to require more than “minimal manipulation” of skin samples, and thus would not qualify for the exemption.

The company has acknowledged in its SEC filings that it has not sought the FDA’s concurrence that its process falls within the guidelines, outlined in Section 361 of the Public Health Service Act.

WHO ARE THE CUSTOMERS?

PolarityTE reported $416,000 in revenue in the three months that ended July 31, with $244,000 coming from its regenerative-medicine business and the rest coming from the veterinary sciences business it acquired earlier this year. It also reported $329,000 in accounts receivable, up from zero three months earlier. That indicates that the company has not been collecting quickly for those services, and raises the question of whether — and to what extent — insurers are reimbursing medical providers for the treatments.

PolarityTE executives declined to say during a post-earnings conference call how many facilities were using SkinTE. They said the figure would not be relevant if some of the users were large healthcare systems with multiple locations and some were single centers.

Despite PolarityTE’s claims about the success of its technology, it has never provided direct evidence, in the form of the results of clinical trials, or even a peer-reviewed article in a scientific publication.

And so far, virtually all of the doctors who have spoken favorably about PolarityTE’s technology in news stories and at scientific and investment conferences are members of the company’s board or advisory council. They have been compensated with stock or options, in some cases hundreds of thousands of dollars worth.

PolarityTE’s prospects for acceptance of its SkinTE treatment, as well as its companion bone-regeneration technology called OsteoTE, rest with winning reimbursement approval from insurance carriers. Lough said in the conference call earlier this month that the company had yet to receive a unique Centers for Medicare & Mediciad reimbursement code for its treatment, but that it expects to have one by January.

A REDUCTION IN RESEARCH AND DEVELOPMENT?

Polarity’s financial presentations create the image of a company pushing hard to extend its core technology beyond skin regeneration, to tissue and bone. However, PolarityTE’s latest quarterly SEC filing, submitted Sept. 14, shows that its spending on research and development plunged in the three months that ended July 31.

According to the filing, PolarityTE spent $2.3 million on research and development in the most recent quarter, down almost 60 percent from the previous quarter. What’s more, the breakdown of that spending listed little in the way of direct research.

The filing showed that the three biggest line items were stock compensation ($1.2 million), salary ($500,000) and equipment depreciation ($300,000). PolarityTE’s breakout did not list any spending on medical studies or medical samples. But given the overall spending total, that figure could not have exceeded $300,000. The company reported spending $500,000 on those two items in the prior quarter, and $800,000 in the quarter before that.

We also noted that PolarityTE’s reported spending on salaries within the research and development segment fell by 70 percent from the two previous quarters, which totaled $1.5 million and $1.7 million, respectively.

All told, PolarityTE reported $14.5 million in research and development spending for the first nine months of the current fiscal year. Of that, $9 million was stock compensation and salary, $700,000 was office, travel and meal expenses and $600,000 was rent.

We checked to see whether the reduction in research and development spending could be explained by a shift to another category. But PolarityTE’s income statements in SEC filings show that while spending for the only other category – general and administrative – rose by $4 million from the prior quarter, most of that increase was attributable to higher stock compensation. Indeed, PolarityTE said stock grants and options accounted for $8.7 million of its $32.1 million in general and administrative spending in the first nine months.

PolarityTE has not responded to three sets of questions submitted by Sharesleuth.

A DAISY CHAIN OF DEALS

Sharesleuth reported in the first story in this series that PolarityTE, Riot Blockchain and another Honig-backed company whose stock made a big, sudden move last year were linked by undisclosed relationships that raised red flags about deals that helped attract investors, boost share prices and enrich certain players,. We found that Honig and a handful of associates sold at least $70 million of stock in PolarityTE, Riot Blockchain, and Marathon Patent as their share prices rose by triple digits, then tumbled from those highs.

The companies, by comparison, had less than $1 million in combined revenue in fiscal 2017, and $180 million in losses

We also found that surges in their share prices were aided by a daisy chain of deals involving Honig and a recurring cast of partners and investors. They included Stetson, O’Rourke and Groussman, who once headed Marathon Patent’s predecessor and was a large shareholder in all three companies. Our report showed how a limited partnership purportedly controlled by O’Rourke provided $5.3 million in financing to Marathon Patent last August and September, just before that company pivoted into the bitcoin business.

We found that the partnership, Revere Investments LP, wound up with the equivalent of 11.8 million Marathon Patent shares. We estimated that Revere sold a portion of that stock for nearly $14 million late last year and early this year, and still had shares with a market value of more than $8 million.

Marathon Patent’s stock peaked at $10.03 on Nov. 27. It now trades for around 80 cents.

What follows is a detailed history of the financing transactions and share sales at PolarityTE and Riot Blockchain, as well as the mergers, acquisitions and other attention-grabbing developments that helped boost their stock prices, if not their fortunes.

It shows how Honig and members of his group benefited every step of the way, acquiring more stock just before certain deals, and even swapping out-of-the-money warrants for additional common or preferred shares, at no extra cost.

POLARITYTE GOES PUBLIC

As we noted earlier, PolarityTE went public through a reverse merger with Majesco, a video game maker that Honig and his associates had been financing since 2014.

SEC filings show that, in mid-2015, Honig, Brauser, Frost and Groussman owned more than 20 percent of Majesco’s outstanding common shares. That stake excluded millions of additional shares issuable upon conversion of preferred stock.

Honig and Brauser were co-chairmen of the company’s board of directors. Honig doubled as chief executive. Stetson was chief financial officer.

Michael Beeghley, who later became chairman and CEO of Riot Blockchain, was on Majesco’s board. Other directors included Kaplan, now a director of Riot Blockchain and U.S. Gold, and Edward Karr, the now-CEO of U.S. Gold.

As Majesco, the company raised $11.5 million through two private placements. Participants in a December 2014 placement paid $6 million for Series A preferred stock with an initial conversion price of 68 cents (not adjusted for reverse split).

That was the equivalent of 11.4 million common shares. They also got warrants for an additional 11.4 million common shares, also exercisable at 68 cents. Later registration statements show that Honig, Brauser, Frost and Groussman were the main purchasers.

In April 2015, Majesco retired the warrants from that placement by issuing Series B preferred stock that was convertible to 6.3 million common shares (not adjusted).

The following month, the company raised $5.5 million, selling common stock and Series C preferred stock that was convertible at $1.20 a share. That deal also included warrants exercisable at $1.40. Once again, Honig, Brauser, Frost and Groussman bought more than 80 percent of the placement.

SEC filings show that a little over $9 million from the two placements was held in escrow until Sept. 30, 2015, when it was released in conjunction with yet another exchange agreement. As part of a deal with the lead investor (Honig), Majesco replaced 4.21 million warrants from the May placement with Series D preferred stock that was convertible to 1.68 million shares (not adjusted). Those warrants could not have been exercised at a profit, given the decline in the company’s share price between May 15, 2015 and Sept. 30, 2015. The new shares were issued at no cost to the warrant holders.

Honig took over as chairman and chief executive immediately after the exchanges, on Oct. 2, 2015. Stetson was appointed executive vice president and chief operating officer.

On Jan. 4, 2016, Majesco said it would pay the $10 million in special dividends to holders of its common stock and all of its preferred stock. It distributed the cash on Jan. 15.

A registration statement shows that the outstanding preferred stock was convertible to 17.7 million common shares, or nearly two-thirds of the company on a fully diluted basis.

As a business, Majesco continued to falter. It reported just $1 million in revenue for the first half of 2016, down from $5.2 million in the same period of 2015. Its net loss widened to $7.7 million, from $5 million.

MORE MANEUVERS

In April 2016 – just three months after paying the special dividend — Majesco raised new cash, selling 1.5 million common shares at $1 each. The placement included warrants to buy a further 1.1 million shares.

In August 2016, Majesco executed a 1-for-6 reverse stock split, to keep its waning share price high enough to maintain its Nasdaq listing. Next, it filed a registration statement covering the resale of 3.48 million shares, much of it issuable upon the conversion of Series A, B, C and D preferred stock.

The registration listed Honig with 284,905 common shares, including options. It said he controlled an additional 884,085 shares underlying preferred stock. Majesco noted that those shares were excluded from the total because of beneficial ownership limits affecting the conversion of those shares.

The SEC alleged in its complaint against Honig, Frost, Brauser and the others that similar ownership restrictions were attached to convertible securities at BioZone, MGT and Mabvax. It said the purpose was to help them conceal their true ownership by ensuring that they would seldom, if ever, have to report owning more than 4.99 percent of a company’s shares (or 9.99 percent in certain instances).

The Majesco registration showed that most of the stock that Honig, Brauser, Frost and Groussman were offering to sell in the second half of 2016 were the “excluded” shares underlying the four classes of preferred.

That would have allowed them to sell hundreds of thousands of shares without having to report a decrease in their previously disclosed beneficial ownership percentage.

Based on the breakdown in Majesco’s registration, Honig’s total holdings equaled 1.17 million shares. He was offering to sell roughly 850,000 common shares underlying his preferred stock. But it appears from later filings that he kept his entire stake even after the registration was declared effective.

Frost was listed as holding 281,140 shares through Frost Gamma Investments Trust, including 38,500 underlying Series A preferred stock. Frost Gamma is one of the defendants in the SEC case.

Frost’s total excluded an additional 543,555 shares underlying all four classes of preferred stock. Thus, his combined holdings totaled 824,695 shares.

Michael Brauser was listed with 235,784 shares, including options and stock held by a retirement plan for Grander Holdings Inc. Grander Holdings is one of the defendants in the SEC pump-and-dump case.

Brauser’s total excluded 795,471 additional shares, nearly all of them underlying preferred stock. Thus, his combined stake amounted to 1.03 million shares.

Melechdavid Inc., a company controlled by Groussman, was listed with 175,155 shares, all underlying preferred stock. It excluded 94,056 additional shares, also underlying preferred stock, bringing the total to 269,211.

Melechdavid is one of the defendants in the SEC case. The registration had a separate entry for Melechdavid’s retirement plan. It was listed as owning 105,041 shares, all underlying preferred stock. We think those were additional shares.

If that was the case, Grousman’s combined stake equaled 399,252 shares. The filing listed a further 25,000 common shares held by Groussman’s charitable foundation, which would push his grand total to 424,252.

O’Rourke, who later would become CEO of Riot Blockchain, was listed as owning 55,721 shares. That consisted of 19,923 shares he held personally and 35,798 held by ATG Capital LLC, an entity he controls. ATG Capital is a defendant in the SEC case.

Stetson was listed with 236,079 shares, including options. His tally excluded 22,731 shares underlying preferred stock. That brought his grand total to 258,810 shares.

Some of those shares were held by Stetson Capital Investments Inc., another of the defendants in the SEC case.

The registration showed that Honig and those five associates controlled 3.7 million shares in the months leading up to the PolarityTE deal, or almost two-thirds of the company’s stock on a fully diluted basis.

Majesco was still a rapidly declining business at that point. SEC filings show that it had just $315,000 in revenue for the three months that ended July 31, 2016, down from $1.1 million a year earlier. And its net loss widened to $2.5 million, from $265,000.

FROM COMPUTER GAMES TO MEDICINE

On Dec. 8, 2016, Majesco announced it had signed a definitive merger agreement with PolarityTE. The terms of the deal called for Majesco to issue a new series of convertible preferred stock to Lough and Swanson. It said those shares would be equal to roughly 50 percent of the combined company, on a fully diluted basis. Majesco also announced that it was raising $2.25 million in new capital by selling 750,000 shares at $3 each.

The company filed a registration statement in January 2017 covering the resale of the private placement shares. It also formally changed its name to PolarityTE.

The registration listed three entities controlled by Catherine J. DeFrancesco – DeFrancesco Holdings Inc., DeFrancesco Motorsports Inc. and Namaste Georgie Inc. – as owning 16,667 shares each, for a total of 50,000. SEC filings showed that, in addition to investing in PolarityTE, DeFrancesco was teaming up with Honig in the proxy fight for control of Venaxis Inc., the company that ultimately became Riot Blockchain.

Our analysis of those filings found that six other people who bought shares in PolarityTE’s December 2016 placement also participated in Riot Blockchain’s placements last year.

On January 18, 2017, PolarityTE entered into yet another exchange with investors. It retired the warrants issued to the participants in its April 2016 placement — which could have not have been exercised at a profit — by giving them 0.3 shares for each.

That amounted to 56,250 shares. Those shares had a market value of just over $200,000 on the date of that agreement. They would have been worth more than $2 million when the company’s stock price peaked in June of this year.

NEW SHARE TOTALS

Frost filed an updated Form 13G on Feb. 8, 2017. It listed the entirety of his holdings – both the included and excluded shares — at 824,695, unchanged from his previous report.

Groussman filed his update a few days later. It listed him with 423,013 shares. That consisted of 311,902 common shares and 111,111 shares underlying Series C preferred stock.

Groussman no longer listed 161,827 shares underlying the Series A, B and D preferred stock that he included in his earlier report. That suggests he converted the preferred stock to common.

Honig resigned as PolarityTE’s co-chairman and chief executive on Feb. 8, 2017 and was replaced by Lough. Brauser also resigned as co-chairman. A proxy filing a few weeks later showed that Honig got a stock grant of 125,000 shares under the company’s 2017 equity incentive plan just days before he stepped down.

Those shares would have a market value of more than $2.5 million today.

The filing showed that Brauser got a grant of 75,000 shares and Stetson got a grant of 175,000. Beeghley, a board member who soon would become chairman and CEO of Riot Blockchain, got a grant of 15,000 shares.

MOVING TOWARD THE MERGER

PolarityTE’s stock began 2017 at $3.23 a share. By late February, it had more than doubled, hitting a high of $8.98 as the merger date drew closer.

Honig filed an amended Form 13D on March 2, 2017. It listed his holdings at 465,738 shares, or 10.7 percent of PolarityTE’s outstanding shares. That was an increase of 180,833 shares, and primarily reflected the stock grant he received.

Honig’s reported holdings excluded 884,086 shares underlying his Series A, B, C and D preferred stock. That number was unchanged from previous filings.

His new grand total was 1,349,824 shares.

Majesco and PolarityTE completed their merger on April 5. The company’s stock closed that day at more than $13. PolarityTE’s share price and trading volume surged later that month, with the stock going from $12 to almost $20 in seven trading sessions.

In its next quarterly financial report, PolarityTE said that in the six months that ended April 30, holders of its Series A, B, C and D preferred stock converted portions of each series, receiving 971,860 common shares.

PolarityTE’s stock kept climbing, topping $30 on June 26, 2017. At the end of that month, however, trading volume fell sharply and the stock price declined as well.

A FAVORABLE FORBES FEATURE

PolarityTE’s share price was back down to $20 by early August. SEC filings show that the company had just $3 million in cash at the time — enough for only another quarter or two of operations without additional capital.

Last Aug. 8, PolarityTE was featured on Forbes.com, in an article whose headline asked “Will This Biotech Be The Next Amazon or Tesla?”

Its stock price rose more than 25 percent in the week that followed. And on the last day of August, it reached a new high of $32.63.

The article was written by two outside contributors — business professors who were partners in an innovation-oriented consulting firm and also had written another, more generic piece for Forbes..

One of the authors, Jeff Dyer, was a board member at PolarityTE. Although that was disclosed in a note at the end of the article, the disclaimer did not say that the company had granted him options to buy 141,000 shares at an exercise price of $3.12 a share, and that he stood to profit from any increase in the stock.

Dyer’s options, which are not fully vested, have an in-the-money value of $2.5 million at current prices.

The SEC inquired about the story in correspondence with PolarityTE, questioning whether it constituted improper “market seasoning,” since the company had a registration pending

Although PolarityTE acknowledged in a letter that Dyer exchanged multiple drafts of the article with Lough and Swanson, it argued that the piece was similar to others that had been published about the company in the ordinary course of business.

UPDATED SHARE TOTALS

PolarityTE’s definitive proxy filing for its 2017 annual shareholders meeting listed Frost with 640,738 shares as of Sept. 12. That total represented a drop of more than180,000 shares.

Frost’s total no longer included any shares underlying Series A, C or D preferred stock. That suggests that he converted those classes and sold 180,000 of the 300,000 common shares he should have received.

It’s also possible that he sold some of the preferred stock to others without converting it.

The proxy filing listed Groussman as holding 569,930 common shares, a healthy increase from his previously reported position. It listed Groussman with 155,039 shares underlying Series C preferred stock. That was up almost 44,000 shares from the 111,111 that he previously reported as underlying his Series C stock.

The filing listed Honig with 187,795 shares underlying Series C preferred stock. That, too, represented an increase of almost 49,000 from his previously reported total of 138,889.

It listed Brauser as holding 116,412 shares underlying Series C preferred stock. That was up roughly 31,000 shares from his previously reported total of 85,247 shares.

It appears from SEC filings that the extra 124,000 shares reflected a reduction in the conversion price of the Series C stock, from $7.20 per common share to $5.16. Although PolarityTE’s filings did not provide details, we think the reduction was triggered by the December 2016 share placement, which had a lower price per share than the one established in the March 2015 financing (after adjusting for the reverse split).

We noted that the September proxy filing listed Honig with 680,100 common shares underlying Series A preferred stock. That was an increase of almost 270,000 shares from the total he reported for his Series A stock in an earlier proxy filing, in February 2017.

It is unclear from SEC filings whether that jump also was attributable to a reduction in the conversion price of the Series A stock, or whether Honig bought additional shares from another holder.

Honig’s grand total on Sept. 12, 2017 was 1.75 million shares, up 400,000 shares from the Form 13D he filed in March. Brauser’s grand total was 1.08 million shares, relatively unchanged from his previous report.

ANOTHER PLACEMENT

PolarityTE announced on Sept. 20, 2017 that it had sold $17.75 million worth of units to accredited investors. The units consisted of one share of Series F preferred stock, convertible to 100 common shares, and warrants equal to half the number of common shares underlying the preferred stock.

The headline of PolarityTE’s press release noted that the placement was priced above the market for the company’s shares. The conversion price was $27.50; the closing price on the day the shares were issued was $25.69.

Subsequent SEC filings show that Honig bought nearly half of that preferred stock. He told Sharesleuth in an email in July that the company was having trouble raising additional capital from outside sources, so he provided it. Groussman also participated.

At the start of October, the Deseret News reported that PolarityTE was buying former Fairchild Semiconductor facility in West Jordan, Utah, for $21 million. It included a 300,000-square-foot building on 60 acres.

Lough told the paper that the company expected to invest $70 million in the operation, including a second building on an adjacent parcel. He added that the company hoped to employ 1,000 people in three to five years.

PolarityTE never went through with the purchase. Instead, it leased 178,000 square feet the property in December, at an annual rent of more than $1 million.

The company also continued to solidify its executive ranks, hiring a new chief compliance officer and signing new employment contracts with Lough, Swanson, Stetson and Cameron J. Hoyler, executive vice president and general counsel. Hoyler, who previously worked at a large law firm, is a fraternity brother of Swanson and Stetson.

HONIG’S HIDDEN SALES

PolarityTE’s stock rallied in early December, nearly reaching $30 again.

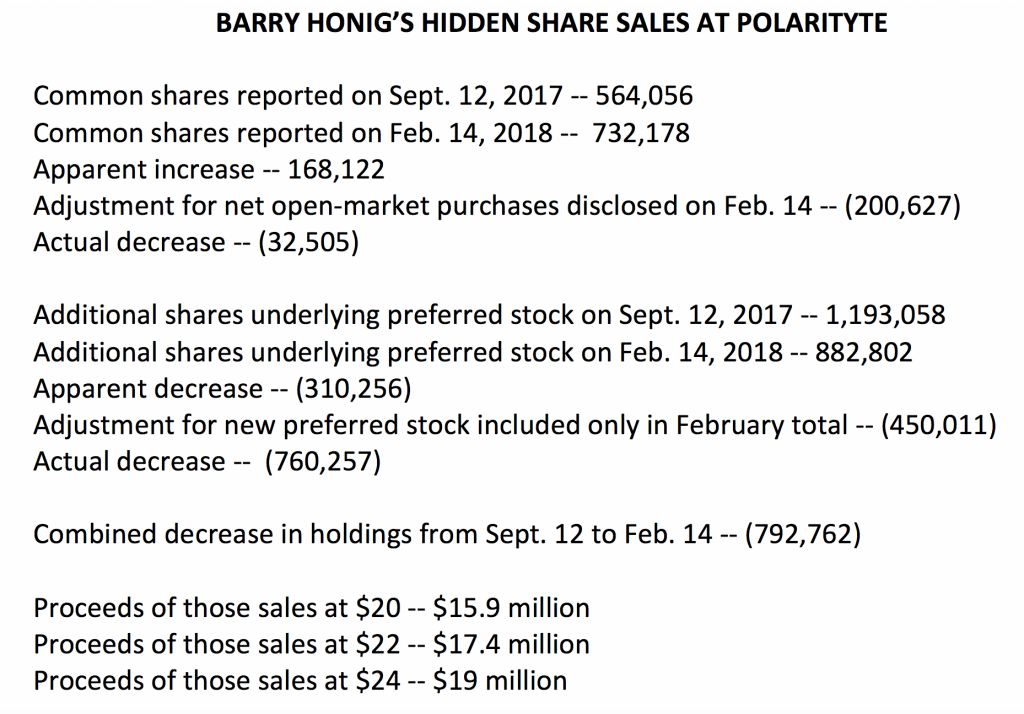

The company filed an amended 10-K at the end of January that included a new ownership chart for officers, directors and other shareholders. It showed big reductions in the shares underlying Honig’s Series A and Series C preferred stock. But it also showed an increase in his common shares, suggesting that his holdings might have simply changed forms.

Honig filed a Form 13D on Feb. 14. It listed him with 732,078 common shares, or just under 10 percent of the company’s total outstanding. That was up from 564,056 common shares in August.

However, the filing included a list of share transactions showing that Honig had acquired a net 200,000 shares between Dec. 12 and Feb. 12. Without those purchases, his total number of common shares would have fallen by roughly 32,000 since the proxy filing.

Honig’s tally in the February filing excluded around 880,000 shares underlying preferred stock and warrants. We noted that 450,000 of those shares were from the Series F placement in September.

Subtracting those left around 430,000 shares, all underlying Honig’s previously issued classes of preferred stock.

PolarityTE’s September proxy filing had listed him with nearly 1.2 million shares underlying the company’s Series A, B, C and D preferred stock. In other words, around 760,000 of those shares were issued to Honig between the time of the proxy filing and the 13D filing.

The net reduction we previously cited in his common shares in that same period means that Honig’s apples-to-apples share count fell by nearly 800,000.

If the numbers in the proxy filing were correct, Honig had to have disposed of those shares between mid-September and mid-February. If he sold them at an average price of $20 a share, at the low end of the range for that period, he would have collected nearly $16 million. If he averaged $23, the proceeds would have topped $18 million.

ANOTHER FAVORABLE EXCHANGE

Honig, Groussman and certain other investors had one more share bonanza early this year. PolarityTE said in an SEC filing on March 7 that it had exchanged all of its still-outstanding preferred stock for common stock. Honig’s remaining Series A and Series B preferred shares became 432,791 common shares.

As part of the exchange, the company also lowered the conversion price on the Series F shares it issued in September from $27.50 to $18.26. That was the closing price on Feb. 26.

Converting the $17.75 million in Series F stock at the lower rate meant an extra 326,616 shares for the holders. It also meant that the “above market” placement that PolarityTE had touted last year was now below market.

The extra common shares issued for the preferred stock had a market value of nearly $6.4 million on the day of the exchange.

PolarityTE also retired 322,727 warrants attached to the Series F stock by issuing 151,872 restricted common shares to the holders. Those warrants had an exercise price of $30, and could not have been exercised at a profit.

The common stock the company issued in exchange for the warrants had a market value of more than $3 million on the day the swap was completed.

PolarityTE also issued 31,324 common shares, worth more than $600,000, to the holders of the Series F stock as an offset for the 6 percent dividends that stock paid.

Honig reported in an SEC Form 4 filing on March 8 that he got 536,954 common shares for his Series F stock and warrants. He previously reported 300,000 shares underlying his Series F stock, plus 150,000 warrants.

The latter two numbers mean that Honig bought $8.25 million of the $17.75 million in Series F stock sold in September, or roughly 46 percent of the total.

At the reduced conversion price, Honig got 451,807 common shares for his Series F stock. He also got 70,588 of the shares issued to replace his out-of-the-money warrants, and 14,559 of the shares issued for the loss of dividends.

The 536,954 common shares that Honig received in the exchange would have had a market value of more than $20 million when PolarityTE’s stock price peaked this summer. The current market value would still exceed $11 million.

Honig said in the Form 4 filing on March 8 that he owned just over 1.73 million shares. He said in an update on July 23 that his total was up to 1.93 million. That stake would have a market value of more than $40 million at Tuesday’s closing price.

A DESPERATION DEAL?

Honig told Sharesleuth in an email exchange in July that PolarityTE needed to retire the Series F preferred stock and all the other classes of preferred stock because its investment bankers said they were an impediment to raising additional capital.

Like PolarityTE’s other financing deals, the Series F placement included price-protections for the investors that entitled them to additional shares and warrants in the event that the company sold new stock at a lower price. By late February, Polarity TE’s stock was below $20, and it was clear that any placement would trigger those protections.

As PolarityTE’s chief financial officer, Stetson — a longtime Honig business partner — would have played a central role in any transaction.

Honig said that he retained independent counsel to negotiate new conversion terms with the company. He said the reduction from $27.50 to $18.26 was the result of several offers and counter offers.

PolarityTE did not respond to questions asking for confirmation of that account.

After the conversion was completed, Polarity raised $32 million, selling just over 2 million shares at $16 a share.

FROST’S SHARE SALES

Frost filed an updated Form 13G on Feb. 6, 2018 . It listed him as owning 480,725 PolarityTE shares, down from 824,295 the previous February and 640,736 in September.

Based on those numbers, Frost disposed of more than 340,000 shares from February 2017 to February 2018.

Our analysis shows that around 185,000 shares disappeared from Frost’s total between February 2017 and September. We think he most likely kept all of those shares until after the merger was completed, in mid-April.

If Frost sold them after the closing an average of $15 — a conservative number for that stretch of time — he would have collected $2.8 million.

If he sold the other 160,000 shares between September 2017 and February 2018 for an average of $20 a share – again, a conservative estimate for that period — he would have received a further $3.2 million. That would have put his combined proceeds at $6 million.

If Frost sold all of his shares at a higher average price, he could have received as much as $8 million.

Frost’s remaining shares would have a market value of just over $10 million, although it’s possible that he has already sold them.

Groussman filed an updated Form 13G on Feb. 13. It listed his ownership at 540,391 common shares, down almost 30,000 shares from the total in the company’s September proxy filing. Groussman no longer listed any shares underlying Series C preferred stock, so it appears that he converted those into common stock.

We also noted that Groussman’s filing no longer included 25,000 shares that had been listed in the name of his charitable foundation. If he sold those shares and the others we described in the previous paragraph, the proceeds could have topped $1 million.

Groussman’s latest tally excluded 54,525 shares underlying Series F preferred stock. By our calculations, he would have received at least 82,115 common shares for his Series F stock through the more generous March conversion plan.

That would have lifted his grand total to 622,506. Those shares would have a market value of $13 million as of Sept. 25.

Brauser filed a new Form 13G in late April. It listed his holdings at 1.41 million shares. He filed an update on June 27, listing his total at 1.43 million shares. That same figure appeared in PolarityTE’s proxy filing last month.

That stake would have a current market value of around $30 million.

Given the SEC’s contention that Honig, Brauser, Frost and Groussman are members of a “control group” and are subject to stricter limits on share sales, it is unclear to how quickly or easily they will be able to cash out of their PolarityTE stakes.

The same is true of their investment in Riot Blockchain. That company said in a recent SEC filing that regulators might block some shares from ever being registered for resale.

RIOT BLOCKCHAIN

Riot Blockchain’s predecessor was originally was known as Venaxis. It was a Colorado-based medical products company that sought to develop a blood test for determining which patients suffering from abdominal pain were less likely to be suffering from acute appendicitis than from other ailment.

In early 2015, the Food and Drug Administration ruled that the test did not meet or exceed the current standard of care. That meant Venaxis no longer had a marketable product. And it quickly found itself facing delisting from the Nasdaq because its share price plunged below the exchange’s minimum.

Venaxis still had plenty of cash, however, having raised $20 million in a stock offering the previous year.

In March 2016, it executed a 1-for-8 reverse stock split. That reduced its outstanding shares to less than 4 million and lifted its stock price well above $1 a share — enough for Venaxis to keep its listing on the Nasdaq. Four days later, Honig disclosed in an SEC filing that he had acquired a 8.65 percent stake in the company, through several entities he controlled.

In September 2016, Honig reported that his stake had risen to 9.6 percent. Catherine DeFrancesco also had been acquiring shares; she disclosed that she had acquired a 7.5 percent interest in the company.

In addition to accumulating shares in Venaxis, Honig sought to block its plan to acquire another Colorado company, Bioptix Inc. Venaxis said in its response that Honig objected because he wanted it to combine with a different company in which he had an interest.

Venaxis and Bioptix went ahead with their deal, which increased the number of shares outstanding by almost a fifth. Honig kept accumulating shares, eventually going beyond the 10 percent mark.

In another filing, he called for the removal of five of the company’s six directors and the payment of a $7.5 million special dividend. He offered five names to fill the board vacancies. They included Stetson, O’Rourke and Jesse Sutton, Majesco’s former chairman and chief executive.

DeFrancesco’s proposed slate also included those three men. Sutton later would resurface as the founder of a bitcoin-mining company called Global Bit Ventures Inc. Marathon Patent – another Honig-backed company — announced a deal in November 2017 to acquire that newly formed business, for stock then worth upwards of $200 million.

Our investigation found that Honig, Stetson and O’Rourke played hidden roles in the financing of Global Bit Ventures, and that a limited liability company headed by O’Rourke was to get nearly a third of the stock to be issued in the merger. However, Marathon Patent and Global Bit Ventures cancelled the deal in June.

Honig also filed suit in state court in Colorado in late 2016, seeking to force a special meeting of shareholders that would include a vote on the proposed changes. Bioptix sought to placate Honig by appointing one of his allies – Beeghley — to its board of directors. He also was on Majesco’s board.

Honig and DeFrancesco continued acquiring shares and said in separate Form 13D filings in January 2017 that they held nearly 23 percent of Bioptix’s stock. Three members of Bioptix’s board resigned soon after, saying they had concluded that Honig was likely to prevail in his legal fight and that mounting a defense would waste corporate recourses.

O’Rourke, who has been involved with Honig at least since 2011, was appointed to one of the vacant board seats. Another Honig ally joined the board as well. And when a longtime Bioptix director stepped down in March 2017, Honig’s group found itself with a majority of the seats, and control of the company.

ADDING SHARES

Later that month, Bioptix raised $7 million in two private placements.

Bioptix sold $4.75 million in notes that were convertible to 1.9 million common shares at $2.50 each. Buyers got warrants for another 1.9 million shares, exercisable at $3.56.

Bioptix also sold $2.25 million in units, consisting of one share at $2.50 and one warrant exercisable at $3.50. SEC filings show that Honig and members of his group were among the biggest participants in both placements.

The financing transactions were completed on March 16, 2017. The $2.50 share price in the placements represented a 30 percent discount from the closing price that day.

SEC filings show that Honig bought at least $1.75 million of the notes. The shares underlying those notes and warrants, plus his original open-market stock purchases, gave him the equivalent of a 20 percent stake in the company on a fully diluted basis.

In April, Bioptix’s chief executive resigned and was replaced by Beeghley, That same month, the company filed a registration statement covering the resale of 5.6 million shares. It covered all 900,000 shares sold in the previous month’s placement, plus 1.9 million shares underlying the convertible notes and 2.8 million shares underlying the warrants.

The filing listed Bioptix’s two top shareholders as Barry Honig and Titan Multi-Strategy Fund I Ltd., managed by Jonathan Honig.

According to the filing, Barry Honig was offering to sell just over 1.4 million shares, all of them underlying notes or warrants from the March placements. Titan was offering to sell 1.6 million, also linked to the notes and warrants.

The registration statement said that Barry Honig would hold 504,000 shares after those sales. That number equaled his original open-market purchases during the proxy fight.

It listed Groussman as controlling 500,000 shares – half in common stock and half in warrants. His total included 340,000 shares and warrants owned by Melechdavid, one of the defendants in the SEC case. The other 160,000 shares and warrants were held by two accounts benefitting Groussman’s children.

Groussman was offering to sell all 500,000 shares.

The filing listed one of Stetson’s companies, Stetson Capital Management LLC, as holding 413,517 Bioptix shares. It was offering to sell 406,017, nearly of all of them underlying notes and warrants from the March placement.

Based on the table in the registration statement, Barry Honig, Titan Multi-Strategy Fund, Groussman and Stetson controlled a little over 4.4 million shares of Riot Blockchain’s common stock.

That amounted to more than 40 percent of the company, on a fully diluted basis. Honig and the others were offering 4 million of their shares for resale.

The other selling shareholders included:

-Aifos Capital LLC, controlled by Edward Karr, the chairman and chief executive of U.S. Gold. Karr also was a director of Majesco prior to its merger with PolarityTE.

-JAD Capital Inc., controlled by Jason Theofilos, the chief executive of a digital advertising company called MUNDOmedia Ltd. Securities filings and media reports show that Barry Honig, Jonathan Honig, O’Rourke, Stetson and Groussman held stakes in MUNDOmedia.

-Adrian James, a stock promoter who previously touted other Honig-backed companies, including Pershing Gold; MusclePharm Inc. (OTC: MSLP) and Valor Gold Corp. (formerly OTC: VLGD).

Honig said in his belated Form 13D in April that he bought $2.25 million of the $4.75 million in convertible notes that Riot Blockchain sold in March 2017. He amended that the next day, saying he purchased only $1.75 million.

Registration statements show that $500,000 in notes wound up with Karr, Theofilos, James and three other associates, who also were listed as selling shareholders.

One of them was Richard Molinsky, a former stockbroker at D.H. Blair & Co. who was barred from the industry in 2000 after pleading guilty to criminal charges related to market manipulation and fraudulent sales practices.

Molinsky has been an investor in numerous Honig-backed companies, including PolarityTE, Pershing Gold and Vapor Corp. (formerly Nasdaq: VPCO). Marathon Patent’s SEC filings on its now-cancelled reverse merger with Global Bit Ventures shows that Molinsky also was one of the bitcoin company’s funders, and was to get shares of the combined company.

Another of the Riot Blockchan shareholders who bought some of the $500,000 in convertible notes was identified in the company’s registration statements as “US Commonwealth Life, A.I. Policy No. 2013-17.” It was listed as owning roughly 40,000 shares underlying the notes, and 40,000 shares underlying warrants.

It was offering all 80,000 for resale. The registration statement listed two Commonwealth Life employees in Puerto Rico as having voting control over that stock.

A more recent registration statement by Massroots Inc. (OTC: MSRT), a company also financed by O’Rourke, Stetson, Groussman and Jonathan Honig, listed that same Commonwealth Life policy as a selling shareholder.

However, that filing said that Mohit Bhansali, the co-founder of Equity Stock Transfer LLC and former director of PolarityTE, had investment control over the securities held in the insurance policy’s name.

Equity Stock Transfer is the transfer agent for PolarityTE. It also acted as transfer agent for Riot Blockchain when the company paid its special dividend last fall.

Equity Stock Transfer’s role in the conversion of preferred stock and notes to common shares – some of which went unreported by holders — raises questions about Bhansali’s investment in Riot Blockchain.

Bhansali also was on the board of directors of Majesco from 2015 to early 2017, resigning just before the merger with PolarityTE was completed. The registration statement that PolarityTE filed in March covering the resale of shares held by current and former officers, directors and employees listed him as offering 15,000 shares.

That stock had a market value of more than $300,000 at the time.

Financial statements that Equity Stock Transfer filed with the SEC show that it has received financing from entities connected to Harvey J. Kesner, a New York-based attorney who was securities counsel for Riot Blockchain and PolarityTE.

Kesner also was securities counsel for BioZone and Mabvax, two of the companies at the center of the SEC’s pump-and-dump case against Honig and his associates. His former firm, Sichenzia Ross Ference LLC, also represented the third, MGT Capital Investments.

Kesner abruptly retired from that firm just before the SEC announced the charges against Honig’s group. Bhansali also was an employee of Kesner’s previous law firm.

Riot Blockchain filed amended versions of its registration statement in July, August and September of 2017. The number of shares listed for Honig remained unchanged, as did those for most other selling shareholders.

Between the filing of the first registration statement in May and the filing of the fourth one in September, Bioptix’s average daily trading volume was well below 50,000 shares, so the ability to dump large amounts was limited.

However, the Form 13D that Honig submitted in April 2018 shows that he nevertheless sold 82,000 of his original 504,000 shares between April 28, 2017 and Sept. 4, 2017, without disclosing any change in his holdings.

RETIRING THE NOTES AND MOVING INTO BITCOIN

Last Sept. 20, Bioptix retired the $4.75 million in convertible notes it had issued earlier in the year, swapping them for Series A preferred stock convertible to 1.92 million common shares.

On Sept. 29, the company made a $3 million strategic investment in goNumerical Ltd, a Canadian cryptocurrency exchange that does business as Coinsquare. That was the first move in its transformation to a bitcoin company.

A few days later, the company said it was changing its name to Riot Blockchain to better reflect its new direction.

Riot Blockchain did not disclose at the time of the Coinsquare deal that Barry Honig, Jonathan Honig, Stetson, Groussman and Brauser also had invested in that company. An amended filing submitted to the SEC on May 25, nearly nine months after the fact, included a chart with their holdings. It also showed that MUNDOmedia’s CEO, Theofilos, and at least six others connected to that company also owned Coinsquare stock.

That list included Eric So, who joined Riot Blockchain’s board a few weeks after the deal. He was the chief legal and corporate development officer for MUNDOMedia.

Even the SEC filing in May did not include any narrative explaining that some of Riot Blockchain’s biggest shareholders also were owners of Coinsquare. The chart showing that was at the end of an exhibit.

THE SPECIAL DIVIDEND

Riot Blockchain announced last October that it would pay a special dividend of $1 a share on its common stock, the new Series A preferred stock and other common-stock equivalents.

It said the dividend would be payable on Oct. 18 to shareholders of record on Oct. 13. The company’s stock jumped 25 percent, going from $6.44 to $8.09 on a volume four times the previous day’s total. That increase in the share price exceeded the pending dividend.

Honig took advantage of the surge. According to the Form 13D he filed in April, he sold 47,420 shares on Oct. 4 at an average of $8.92 a share, collecting $424,000. He sold an additional 21,400 shares on Oct. 5 and Oct. 6, for $162,000.

Just before the dividend cutoff date, Riot Blockchain’s board temporarily reduced the cash exercise price of the warrants issued in the March note and unit placements to $3.00, from $3.56 and $3.50 respectively.

The company’s stock was trading for more than $5 a share at the time, so even before the reduction, the holders were already up 40 percent.

SEC filings show that holders of 620,000 warrants exercised them by paying cash. Holders of 2.06 million warrants (1.7 million linked to the preferred stock) exercised them using a cashless option, and got 1.23 million shares.

In addition, holders of the company’s Series A preferred stock converted about 40 percent of the outstanding shares, trading them for 828,404 common shares.

Honig’s Form 13D from April shows that he got 294,950 Riot Blockchain shares through warrant exercises on Oct. 5 and 6.

By our count, he had roughly 380,000 common shares prior to that. The warrant exercises lifted his total to around 712,000, or 12 percent of those outstanding (based on 5.4 million shares at Sept. 20, plus his exercises). He did not report that increase in his holdings.

Riot Blockchain elevated O’Rourke to president on Oct. 9, putting one of Honig’s closest associates in the No. 2 position at the company.

Honig’s belated disclosure statement shows that he sold 202,544 shares on Oct. 9 and 10, for $1.78 million. He added more than 630,000 shares on Oct. 11 — 128,988 through warrant exercises and 505,124 through the conversion of much of his preferred stock.

Those acquisitions were offset by the sale of 293,916 shares on Oct. 11 and 41,600 shares on Oct. 12. The proceeds from those transactions totaled just under $3.3 million.

Honig’s Form 13D shows that he sold more than 600,000 shares in a 10-day period, collecting nearly $5.7 million and cutting his ownership to less than 3 percent, without alerting the investing public to those moves.

A NEW SHARE COUNT

Riot Blockchain had 5.45 million common shares outstanding at the end of September 2017. The warrant exercises and preferred stock conversions would have added 2.68 million shares, lifting the total to 8.13 million shares.

Riot Blockchain’s quarterly financial report showed that finished the three months that ended Sept. 30 with $13.1 million in cash. The money paid to exercise warrants would have added $1.9 million, pushing the total to around $15 million.

Riot Blockchain then distributed $9.6 million, or nearly two-thirds of its cash, in dividends.

It is impossible to say how much went to Barry Honig, Jonathan Honig, Stetson, Groussman and DeFrancesco without knowing how many warrants they exercised with cash and how many they exercised cashlessly.

But we estimate that, based on their reported holdings on or about the dividend date, Barry Honig, Titan Multi-Strategy Fund, Groussman, Stetson and DeFrancesco got at least $3.5 million.

EXTRAPOLATING OWNERSHIP NUMBERS

According to Riot Blockchain’s April 2017 registration statement, Barry Honig and Jonathan Honig accounted for 1.52 million of the 1.91 million warrants attached to the convertible notes (later the Series A preferred stock). It follows that a large percentage of their warrants were among the 1.7 million exercised cashlessly.

Jonathan Honig filed a Form 13G on Oct. 11. It listed his ownership at 639,920 shares, consisting of 551,920 shares held by Titan Multi-Strategy Fund and 88,000 held by another entity, Four Kids Investment Fund LLC.

That total excluded 808,198 shares underlying preferred stock that was subject to beneficial ownership restrictions. Thus, his grand total was just over 1.4 million shares.

Riot Blockchain’s earlier registration statement listed Jonathan Honig with 15,000 actual shares, plus 800,000 shares underlying warrants and 824,066 shares underlying convertible notes.

That means that unless he sold shares in the interim, he converted those 800,000 warrants in such a way as to yield 600,000 common shares.

We calculated from Barry Honig’s Form 13D filing that he held around 760,000 shares on Oct. 13, the date that determined which shareholders collected the $1 special dividend.

That represented a portion of his original stake in the company and a portion of the stock he received through warrant exercises and note conversions.

The Form 13D he submitted in April shows that he also held unconverted notes equal to 202,050 shares on Oct. 13. That mean he had a little over 960,000 shares and stood to collect around $960,000 million in dividends.

Groussman filed a Form 13G on Oct. 13, 2017, listing his ownership at 399,202 shares. That covered 271,458 shares held by Melechdavid and 63,872 held by each of the two accounts benefitting his children.

Those updated numbers were consistent with Groussman exercising all 250,000 of his warrants cashlessly.

Stetson did not own 5 percent or more of Riot Blockchain’s stock and was not required to file Form 13Gs, so his holdings were not updated in any SEC filings. If he had not sold any of his stake prior to October and exercised his 200,000 warrants cashlessly, he would have received 120,000 shares.

That would have given him 127,500 actual shares, plus an additional 205,000 shares linked to his Series A preferred stock, for a total of 332,500 shares.

Based on those calculations, the two Honig brothers, Groussman and Stetson would have held nearly 2.9 million Riot Blockchain shares or their equivalents as of mid-October.

That equaled roughly 40 percent of the company’s shares, on a fully diluted basis.

DeFrancesco had not reported any changes in her holdings since the Form 13D she submitted in January 2017, which listed ownership of 515,777 shares.

A NEW INVESTOR

We noted that between the time Riot Blockchain filed its initial registration statement in April 2017 and the time it filed an amended one in July 2017, one large block of shares and warrants apparently changed hands.

The original filing listed Andrew Schwartzberg, who runs a mortgage company in Maryland, as owning 450,000 shares of stock and 450,000 warrants from the March placement.

The amended filing listed Northurst Inc. as owning 800,000 of those same shares and warrants. Northurst, a Canadian company, later would emerge as one of the biggest shareholders in Kairos, the bitcoin company that Riot Blockchain acquired last November.

Although Schwartzberg’s 450,000 shares would have made him the holder of more than 5 percent of the company’s stock, he never filed a Form 13G disclosing that stake.

SEC filings show that Schwartzberg also was an investor in PolarityTE. In addition, he was early investor in Marathon Patent and provided money to Global Bit Ventures, the bitcoin miner that it planned to acquire. He was to get nearly 200,000 shares of the combined company through that transaction.

In the first story in our series, we linked Northurst to David Baazov, the former head of a Montreal-based internet gambling company now known as The Stars Group Inc. (Nasdaq: TSG). One of his investment companies also was a shareholder in MundoMedia, the advertising company in which Honig, O’Rourke, Stetson and Groussman had stakes.

Northurst also owned a big chunk of Global Bit Ventures.

ANOTHER CRYPTOCURRENCY DEAL

On Oct. 16, Riot Blockchain announced that it was acquiring a 52 percent stake in another bitcoin-related business, Tess, which like Coinsquare was based in Toronto. It paid with $320,000 in cash and 75,000 shares of stock.

On Nov. 3, Riot Blockchain said it had acquired Kairos Global, an upstart bitcoin miner, for 1.75 million shares of Series B preferred stock. They were convertible into an equal number of common shares.

Riot Blockchain’s chief executive, Beeghley, stepped down that same day. He was replaced by O’Rourke, who was given an annual salary of $300,00, plus 344,000 shares of restricted stock and 100,000 options exercisable at $10 each.

O’Rourke also was elevated to chairman of the board.

At the time, O’Rourke was a significant investor in Marathon Patent, by virtue of his voting and investment authority over Revere Investments’ $5.3 million in convertible notes and the millions of warrants that went along with them.

In late October of 2017, Riot Blockchain adopted a new code of ethics and business conduct that included a detailed section on conflicts of interest.

The new code of ethics expressly stated that a conflict could exist if a director, officer, or employee “lends to, borrows from, or has a material interest (equity or otherwise) in a competitor, supplier, or customer of the Company, or any entity or organization with which the Company does business or seeks to do business.” It added that the person would require a waiver from the board.

When Marathon Patent announced on Nov. 2 that it had agreed to acquire Global Bit Ventures — another bitcoin miner – that put O’Rourke squarely in violation of Riot Blockchain’s conflict of interest policy.

Riot Blockchain has never mentioned O’Rourke’s involvement with Marathon Patent or said whether he had been granted a waiver from its policies.

Riot Blockchain announced Nov. 16 that it had made an investment in another cryptocurrency company, Verady LLC. That’s when the company’s share price took off, along with the bitcoin market in general, going from $8.13 on Nov. 17 to $10.35 on Nov. 18, $15.99 on Nov. 22 and $23.60 on Nov. 24.

More than 40 million shares changed hands in that period.

On Dec. 4, Riot Blockchain announced that an investor bought 10 percent of Coinsquare for $10.5 million, giving that company a valuation of $110 million. That implied that the value of its similarly sized stake had appreciated by millions of dollars.

On Dec. 11, Riot Blockchain said that Tess had entered into an agreement in which it would go public through a reverse merger with Cresval, the Vancouver-based mining company.

The terms called for Cresval to issue 80 million shares to Tess’ owners, giving them 90 percent of the stock in the combined company. Riot Blockchain said it would get 41.6 million shares.

As we noted earlier, Cresval said in a recent securities filings that Honig was the intermediary who introduced its chief executive to O’Rourke, for the purposes of discussing the Cresval-Tess merger.

We also found a 2016 investor presentation showing that Kaplan, a current director of Riot Blockchain and former director of Majesco, had been an advisor to Cresval. He also is a director of two other public companies – Avino Silver & Gold Mines Ltd. (NYSE: ASM) and Coral Gold Resources Ltd. (OTC: CLHRF) – run by some of the same people.

The news about Tess going public helped set off another surge in Riot Blockchain’s shares. They had closed the previous Friday at $15.86. They opened on Dec. 11 at $19.06 and ended the day at $23.08, with more than 20 million shares traded.

The stock closed at $28.20 on Dec. 12, after reaching an intraday high of $33.27. More than 36 million shares changed hands.

Trading remained heavy for the next week, with the stock climbing above $40 for the first time on Dec. 18 , then peaking at $46.20 on Dec. 19.

Riot Blockchain announced on Dec. 19 that it entered into subscription agreements with accredited investors for 1.6 million shares of restricted stock priced at $22.50 – or roughly half the prevailing market price — plus an equal number of warrants exercisable at $40 each. The company said it would use the $36 million in net proceeds to finance its growth.

NEW DETAILS EMERGE

On Jan. 5, Riot Blockchain filed an amended Form 8-K on its acquisition of Kairos. It contained audited financial statements for Kairos, including details about its capital structure and ownership.

The balance sheet in that filing showed that Kairos’ assets just prior to the acquisition consisted of $1.1 million in cash and $2.1 million in equipment.

The filing also showed that Kairos had raised virtually all of its capital just days before the Riot Blockchain deal, issuing 1.75 million shares of its own stock in return for $3.18 million.

According to the filing, Kairos sold 750,000 shares at 10 cents each on Oct. 30, and 1 million shares at $3.10 each on Oct. 31. That amounts to an average price of $1.80 a share.

Riot Blockchain agreed on Nov. 1 to issue 1.75 million of its Series B preferred shares as payment for Kairos. Those were convertible to one common share each. On the day of the company’s stock was trading for $6.80 a share.

In other words, the people who bought Kairos shares at 10 cents each got a nearly 7,000 percent return on that investment two days later. Those who bought at $3.10 more than doubled their money, virtually overnight.

Riot Blockchain later filed a registration covering 3.4 million shares and warrants issued in the December placement. We noted that it listed some of the selling shareholders as holding Series B preferred stock as well.

Riot Blockchain did not say that they received the shares through the Kairos deal. But those were the only Series B shares the company had issued, so there was no other explanation.

The list of selling shareholders in the registration included some of the same investors who participated in Riot Blockchain’s earlier placements. It also included familiar names from Honig’s other deals, namely Michael Brauser’s Grander Holdings, plus Hudson Bay Master Fund Ltd. and Intracoastal Capital LLC.

Those three were among the biggest participants in the December placement.

The registration listed Grander Holdings as owning 75,000 Series B preferred shares. It also said Groussman’s company, Melechdavid, held 87,500 of Riot Blockchain’s Series B shares.

The filing listed six entities connected to the DeFrancesco family as owning a combined 135,000 Series B shares. Honig reported in a later Form 13D that he also owned Series B shares, but did not say how they were acquired.

That filing listed Honig as owning 22,222 common shares, 22,222 warrants and 151,210 shares underlying the Series B preferred stock. It said the warrants were not yet exercisable, which meant that they, and the 22,222 common shares, would have been acquired in the December share placement.

Those share figures also meant that Honig no longer held any of the 1.9 million shares and equivalents he was listed as owning in Riot Blockchain’s April 2017 registration statement.

The January registration showed that Northurst controlled nearly 1 million Riot Blockchain shares. That consisted of 388,889 common shares, 100,000 shares underlying warrants and 500,000 Series B preferred shares from the Kairos deal.

Our analysis suggests that no more than 288,889 of those shares could be holdovers from the March 2017 placements, That would mean Northurst sold roughly 400,000 shares during the surge in November and December.

As a Form 13G filer, it was not obligated to disclose its sales immediately. But more than a year has passed since its previous filing, in August 2017, so it is overdue for an update.

Brauser, Groussman, the DeFrancesco entities and Northurst accounted for nearly 800,000 of the 1.75 million Series B shares that Riot Blockchain issued in the bitcoin deal. The addition of Honig’s 151,210 Series B shares means that five investors received more than half the stock from that transaction.

Riot Blockchain filed an amended registration on Feb. 7. It listed Groussman as holding 131,945 shares, consisting of 44,445 common shares and 87,500 shares issuable on conversion of Series B preferred stock.

That breakdown suggests that Groussman disposed of at least 354,747 of the 399,202 shares he listed in his Form 13G in October. If he sold those shares at an average price of $15 in November, December and January, he would have collected more than $5 million. If he sold for an average of $20 a share, he would have received more than $7 million.

Jonathan Honig filed an updated Form 13G on Feb. 13, listing ownership of 201,291 shares, all held by Titan Multi-Strategy Fund. That was a drop of more than 1.2 million shares from his previous filing in October.

If he sold those shares during the surge, at an average price of $15 a share, he would have collected $18 million. If he sold them for an average of $20 a share, he would have received $24 million.

Although Titan Multi-Strategy Fund sounds like a diversified investment company, our search of SEC filings found that virtually all of the public companies in which it reported stakes were companies linked to Barry Honig.

It does not have a physical office, or a website. The address it uses in SEC filings is Jonathan Honig’s house.