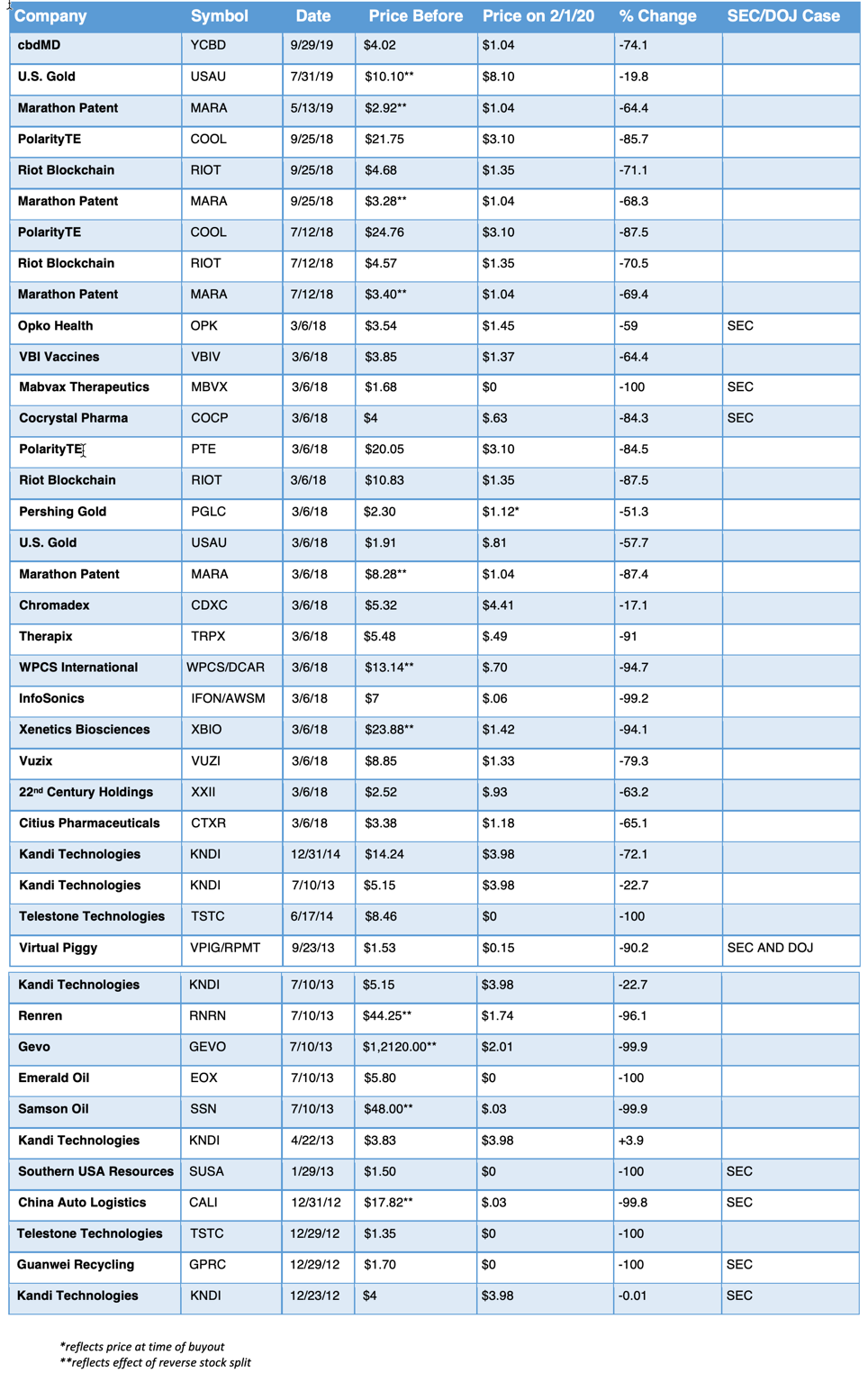

Editor’s note: These results cover stocks listed on the Nasdaq, American Stock Exchange and New York Stock Exchange, plus certain companies whose shares traded on the Over the Counter market and figured into regulatory or law-enforcement action after our investigations. They exclude dozens of other OTC stocks we reported on, most of which have declined by 80 percent to 100 percent.

SUMMARIES OF SHARESLEUTH INVESTIGATIONS

(This list covers all investigations that focused on companies whose shares traded on the Nasdaq, the American Stock Exchange and New York Stock Exchange. It also includes certain investigations into companies listed on the Over the Counter market, where people we mentioned were later charged in civil or criminal fraud cases.)

Xethanol Corp. (Aug. 7, 2006)

Xethanol (formerly AMEX: XNL, later AMEX: GNH) claimed that it had the ability to convert wood chips, grass clippings and other organic materials into ethanol at a price competitive with gasoline. The potential for a viable alternative energy source helped attract publicity and investors. Xethanol’s stock peaked at just over $16 a share in April 2006. The company’s technology proved illusory, however. We found that Xethanol’s supposed research and development facility in a small town in Iowa was non-operational, with no water or sewer service. We also found that one of the company’s biggest initial shareholders had previously settled fraud charges with the SEC, and that its CEO, Christopher d’Arnaud-Taylor, had greatly exaggerated his resume. Xethanol said he had “global senior corporate executive experience” with several multinationals, some of whom could not confirm his employment in any capacity. D’Arnaud-Taylor stepped down shortly after our story appeared. After spending heavily on additional facilities using cash it raised through private placements, Xethanol ultimately abandoned the ethanol business and sold off those properties. It relaunched itself as Global Energy Holdings in 2008 but filed for bankruptcy in 2009 and was liquidated.

UTEK Corp. (Oct. 25, 2006)

UTEK (former AMEX: UTK, now OTC: INNI) specialized in identifying potentially useful technologies developed by university and government labs, licensing them for outside use, then placing them with other companies – typically for stock in those entities. UTEK was the middleman that provided Xethanol with its core technology. UTEK booked the value of shares from such deals as revenue, and counted them among its assets. We found that much of that stock was issued by thinly trading penny-stock companies or private companies, and that the carrying value UTEK assigned to many of the investments turned out to be wildly inflated. UTEK’s stock reached a high of $23 in July 2006. But the market values of the securities in its portfolio ultimately crashed, taking UTEK’s share price and technology-transfer business down with them. The company renamed itself Innovaro, and repositioned itself as an innovation management consulting business. Its stock was delisted from the AMEX in 2013 and now trades on the over-the-counter market. Innovaro has not released any quarterly reports or other financial information since 2014. Its stock currently is a fraction of a penny per share.

China Fire and Security Group Inc. (March 10, 2008)

China Fire (formerly Nasdaq: CFSG) went public in 2006 through a reverse merger with a U.S.-listed shell company. We found that the deal was one of three packaged by the same group of American financiers, some of whom had previously been connected to stock-manipulation schemes. We also found that some of the people listed in SEC filings as the beneficial owners of entities that had disclosed plans to sell nearly $30 million of China Fire stock appeared to be fronts for the true holders. One of those stand-ins was the sister-in-law of China Fire’s chief executive, Brian Lin. She ran a small health food store in a Vancouver suburb, and according to SEC filings, was the sole shareholder of an entity that said it was selling $9.6 million in stock. Two days after we published our findings, the company held a conference call to clarify the true ownership of its shares, and acknowledged that hidden parties in China had economic interests in millions of shares, including those we had raised questions about. China Fire’s shares had traded for more than $18 in November 2007, and fell as low as $5.70 in the months after our story appeared. The stock rallied again in 2009, reaching a peak of $21.72 in September of that year. But the price fell back to single digits by June of 2010 and hit a new low of $5.50 in February 2011. Three months later, a unit of Bain Capital Partners agreed to acquire China Fire for $9 a share, a 20 percent premium over the closing price on the day the deal was announced.

History and Mystery (July 23, 2008)

This follow up to our China Fire investigation looked at the Americans, including financier Martin A. Sumichrast, who helped bring that company public, along with three other Chinese businesses that gained U.S. listings through reverse mergers. They were: China Bio-Energy Holding Group Co. (formerly Nasdaq: CBEH), QKL Stores Inc. (OTC: QKLS), and Shengkai Innovations Inc. (OTC: VALV). All three started out on the Over the Counter Market but eventually uplisted to the Nasdaq. Their share prices peaked in late 2009 and early 2010. China Bio-Energy’s high was $12.12. QKL Stores’ high was $8.75 and Shengkai Innovations’ high was $10.26. Their share prices eventually crumbled, but not before Sumichrast, his associates and other early investors sold tens of millions worth of stock. An investigation by another group that specializes in uncovering fraud and deception used a hidden camera and time-lapse video to show how China Bio-Energy, which had been renamed China Integrated Energy, faked activity at an idle biofuels plant to fool U.S. investors who came to tour the operation. Our investigation documented Sumichrast’s previous track record of involvement with people who had serious criminal or regulatory histories. For example, we found that the Nasdaq delisted shares of a publicly traded brokerage he headed because it found that two convicted felons had acquired substantial, undisclosed interests in the firm. It also covered Sumichrast’s work as a consultant for another company, Signalife Inc. (previously Recom Management Systems and now Heart Tronics Inc., OTC: HRTT). SEC filings showed that Sumichrast and a partner, Ralph O. Olson, got millions in stock for unspecified services. One former executive testified in a court case that Olson appeared to be manipulating share prices. The SEC later brought fraud charges against the company and the attorney who secretly controlled it, alleging that they put out false statements to help facilitate a pump-and-dump scheme. The Justice Department also brought criminal charges against the attorney, Mitchell J. Stein. He was convicted and sent to prison.

Pure Play Music Ltd. (June 22, 2009)

Pure Play (formerly OTC: PPML) billed itself as online platform where unknown bands and singers could promote and sell their music, and where fans could communicate with the musicians and each other. The company went public in 2008 through a reverse merger. As part of that process, the holder of a $291,000 note issued by Pure Play’s predecessor converted it to 29.1 million shares, which had a market value of more than $70 million when the stock price peaked soon afterward, at around $2.50. Our investigation found that the purported holder of the note was an entity controlled by a Californian named Colin Nix. He was a close associate of Regis M. Possino, a disbarred lawyer and twice-convicted felon. We later turned up documents that showed the 29.1 million shares were distributed to multiple entities. They including two more linked to Possino; one with ties to another convicted felon named Charles J. McGuirk; and one whose signatory, Robin M. Rushing, worked for yet another convicted felon named Harold “B.J.” Gallison. Nix and Possino were indicted in 2013 for their participation in two related pump-and-dump rings that cost investors more than $30 million. Both pleaded guilty and served time behind bars. Gallison, who operated an offshore brokerage in Costa Rica, was indicted in 2015 in connection with other fraudulent activities in which Rushing played a role. Gallison pleaded guilty and now is serving an 18-year prison sentence.

Waste2Energy Holdings (Sept. 17, 2009)

Waste2Energy (formerly OTC: WTEZE) claimed to have a system for turning garbage and other solid waste into burnable gases. It went public through a reverse merger deal that involved the former CEO of Xethanol Corp. (see above), Christopher d’Arnaud-Taylor, and two other key players from that company. Waste2Energy had a deal with a partner to construct an energy plant in Scotland. But it racked up hundreds of thousands of dollars in unpaid bills there, and ultimately was forced into bankruptcy. The SEC later brought charges against a New York-based brokerage firm, Charles Vista LLC, its founder and one of its investment bankers, alleging that they made false and misleading statements about Waste2Energy’s cash position, assets and business prospects in connection with a private placement of convertible debentures that accompanied the reverse merger transaction. Charles Vista settled the charges by agreeing to pay $4.35 million. The individual defendants agreed to pay an additional $525,000.

Rockwell Medical Inc. (Nov. 3, 2009)

Rockwell Medical (Nasdaq: RMTI) supplies dialysis concentrates and solutions to healthcare providers. We noted that a longtime financial consultant who got stock and warrants with a potential value of millions of dollars had been charged by the SEC for his role in a massive fraud scheme at another public company. The SEC alleged that the consultant, Michael J. Xirinachs, and two investment companies he ran purchased 15 billion unregistered shares of Universal Express Inc. (formerly OTC: USXP) at a discount to the market price, then improperly sold them to the public, generating $17.5 million in proceeds. A court entered a judgement in 2012 against Xirinachs and one of those firms, ordering them to pay $10 million in disgorgement, penalties and interest. He later was implicated, but not charged, in the 2013 fraud case involving financier Regis Possino and others mentioned in our prior report on Pure Play Music. Rockwell Medical’s stock traded as high as $9.39 two months before our story appeared, and fell to as low as $5.51 in the months that followed. It reached a new high of more than $15 in late 2013, after the FDA approved the company’s new supplemental iron treatment. However, the company has yet to generate significant sales of that product. Rockwell Medical’s board of directors ousted the chief executive and chief financial officer in 2018, and even though it has made progress under new management, its stock is off more than 80 percent from its peak.

Vicis Capital (May 7, 2010)

Vicis was hedge fund that once had nearly $5 billion under management. It was a major investor in two small, publicly traded companies — Medical Solutions Management Inc. (formerly OTC: MSMT) and MDWerks Inc. (OTC: MDWK) — that were implicated in a fraud scheme involving collections on falsified insurance receivables. Our investigation found that Vicis had a close relationship with another firm, Midtown Partners & Co. LLC, which had paired Vicis with stakes in 20 companies whose stock traded on the Over The Counter market. We found that Vicis received shares and warrants in those companies at deep discounts to the prevailing market prices, and then recorded big paper gains on its holdings, even though those investments were largely illiquid. Christopher D. Phillips, a Vicis managing director who formerly had a top position at Midtown Partners, pleaded guilty to conspiracy to commit wire fraud in connection with the insurance scheme. The chief executive of MDWerks also pleaded guilty to health care fraud. Vicis was hit with heavy redemption requests after the 2008 global financial collapse and ultimately returned all investor capital and left the hedge fund business.

Lenco Mobile Inc. (Feb. 15, 2010)

Lenco Mobile was a digital marketing company that bought up several other businesses in that field, using its stock as currency. At its peak stock price of around $6 a share, the company had a market capitalization of $390 million. Our investigation found that a pair of the businesses it acquired were connected to Michael Wayne Crow, the subject of two previous SEC fraud cases. Our investigation also found that Lenco Mobile went public through a reverse merger with a shell company controlled by a financier named Zirk Engelbrecht, who later used the name Izak Zirk De Maison. He and his wife, former beauty queen Angelique De Maison, were among Lenco Mobile’s biggest shareholders. The SEC brought fraud charges against the couple in 2014, along with six other defendants, in connection with a pump-and-dump scheme involving another public company. The Justice Department followed up with a broader criminal case. The SEC and the Justice Department later amended their complaints to include Lenco Mobile and other companies. Izak De Maison was convicted and sentenced to 12 years in prison. He also was ordered to pay $39.1 million in restitution. Our story also noted connections between Izak De Maison and Thomas Ronk, who controlled one of businesses that Lenco Mobile had acquired. The SEC charged him with fraud in 2018, alleging that he made false and misleading statements to investors about two other De Maison-connected companies whose stocks were part of the broader scheme. He is fighting the charges, and the case is set for trial in March 2021. Lenco Mobile wound up in bankruptcy, and the SEC revoked the registration of its shares. The SEC brought another case against Crow in 2014, alleging that he raised roughly $4 million from investors under false pretenses for a purported Peruvian mining operation.

Sinocoking Coal and Coke Chemical Industries Inc. (March 11, 2010)

SinoCoking (formerly Nasdaq: SCOK) was a China-based coal and coke supplier whose stock price rose tenfold after it went public through a reverse merger with a Canadian shell company in February 2010. It raised $44 million around the time of the deal, selling shares for $6 each to U.S. and foreign investors. Those buyers also got warrants for more than 3 million additional shares for $12 each. Within a few weeks, SinoCoking’s stock had reached a peak of $53.70. Even after a sharp pullback, they were trading for $34 a month after the placement, giving those investors paper gains of more than $250 million. SinoCoking was dogged throughout its existence by questions about its major Chinese shareholders and its operations. By the fall of 2010, its stock was below $10, and by early 2013, it was down to $1. SinoCoking changed its name to Hongli Clean Energy Technologies (OTC: HGLI) in 2015 and its shares were delisted from the Nasdaq in 2017. They now trade for 3 cents on the Over the Counter market.

Vicis and Midtown Partners & Co. (March 30, 2010)

Our follow-up on the Vicis Capital and its investments outlined even longer-standing connections between Vicis, Midtown Partners, another investment firm called H.C. Wainwright & Co., and other companies, some of which failed or faced SEC charges. We found that the partners in Vicis had previously been involved in another fund, Victus Capital, with a wealthy entrepreneur in Florida. We also found that Christopher Phillips, a Vicis managing director who previously worked for Midtown Partners, was employed by another of that entrepreneur’s companies and was a director of his foundation. As we noted in the summary of our original report, Phillips pleaded guilty in 2011 to conspiracy to commit securities fraud in connection with an insurance billing scheme involving two of Vicis’ portfolio companies. Phillips also figured into a case the SEC brought in 2013 against Shadron L. Stastney, one of Vicis’ three principals. The SEC alleged that Stastney breached his fiduciary duty to the Vicis Capital Master Fund by arranging for it to buy $7.5 million of illiquid securities, without disclosing that he had a financial interest in the shares. He got $2.8 million of the proceeds. Although the SEC’s order in the case did not identify Phillips by name, the details make clear that Phillips was the person who sold the securities to Vicis, around the time he joined the fund from Midtown Partners. Stastney was ordered to pay almost $2.9 million in disgorgement, penalties and interest.

Mesa Energy Holdings Inc. (April 11, 2010)

Mesa (formerly OTC: MSEH) was a small oil and gas exploration company that was already publicly traded when it merged into another one, a shell called Mesquite Mining. Our investigation found that 14 million shares of the combined company wound up in the hands of four investors from the Mesquite side of the deal. One was a limited partnership linked to a convicted felon and barred broker named Samuel DelPresto. Another was an entity controlled by Adam S. Gottbetter, a lawyer who specialized in reverse mergers, private placements and other securities transactions. We noted that the two had previously been involved in another public company called Kentucky USA Energy Inc. Mesa’s stock rose sevenfold between the time of the Mesquite Mining deal, in December 2010, and March 2011, when it peaked at $3.50 a share. We found that the holders of the 14 million shares sold at least 6 million of them in that period, which coincide with a paid promotional campaign that included slick direct mail pieces touting Mesa’s prospects. Mesa never lived up that hyoe, and in 2013 it merged into Armada Oil Inc. in a deal valued at 22 cents a share. Armada later filed for bankruptcy. DelPresto and Gottbetter both were charged by the SEC and the Justice Department in 2015 in connection with pump-and-dump schemes involving Kentucky USA Energy and other microcap companies. Both pleaded guilty to criminal charges and served prison sentences. The SEC and DOJ complaints against DelPresto later were amended to included Mesa among the companies whose shares were manipulated. A third partner, Nathan B. Montgomery, also pleaded guilty to criminal charges in 2016 in connection with the schemes at Mesa and other companies.

Houston American Energy Inc. (June 28, 2010)

Houston American (AMEX: HUSA) claimed that an oil prospect in Colombia in which it had invested held between 1 billion and 4 billion barrels of recoverable reserves. That figure exceeded the proved and probable reserves for the entire country. Houston American’s stock rose from $2 a share in July 2009 to a high of more than $20 in April 2010, giving the company a market capitalization of nearly $700 million. That rise was aided by two newsletters that promoted the stock. One, Undiscovered Equities, listed Houston American among its top stock picks for 2009 and 2010. However, all of the wells the company drilled at the Colombian prospect, known as CPO-4, were busts. The SEC later charged Houston American, its then-chief executive, John F. Terwilliger, and Undiscovered Equities and its operator of misleading investors through fraudulent statements and omissions that “materially exaggerated” the value of CPO-4 and downplayed any associated risks. The SEC also alleged that Terwilliger made false statements about the status of the drilling campaigns at CPO-4 and whether the results showed the presence of hydrocarbons. Terwilliger settled the charges against him, agreeing to pay $550,000 in penalties He also was barred from serving as an officer or director of a public company for five years, and resigned from his position at Houston American. Undiscovered Equities and its operator were ordered to pay an additional $22,500.

Telestone Technologies Corp. (Aug. 11, 2010)

Telestone (Nasdaq: TSTC) was a Chinese company that gained a listing in the United States through a reverse merger. The company, which supplied equipment and services to mobile telecommunications providers, reported a sharp increase in revenue and profits from 2008 to 2009, and projected continued rapid growth in the years ahead. But our investigation found that it had more than $95 million in accounts receivable at the end of 2009, an amount equal to all of its revenue for that year, and two-thirds of its revenue from the previous year. We noted that unless Telestone could collect on those receivables, the growth story that contributed to a 20-fold increase in its stock price from March 2009 to January 2010 would fall apart. Telestone explained that it had little power to force timely payments from its main customers – China’s three big mobile phone companies – but added that they were multibillion-dollar enterprises that would make good on those obligations. Telestone’s shares were trading for around $13.50 before we published our findings. The company reported another solid revenue increase in 2010, followed by declines in 2011 and 2012 – when it stopped submitting quarterly and annual financial statements altogether. The SEC revoked Telestone’s registration in 2016.

China Fire and Securities Group Inc. (Aug. 20, 2010)

Our continued monitoring of China Fire (formerly Nasdaq: CFSG) revealed that an entity called Vyle Investment Inc, headed by the company’s chief executive, transferred 1.8 million shares worth nearly $28 million to two other parties, who in turn gave up their 70 percent interest in Vyle. Neither of those parties were listed previously as beneficial owners of Vyle, raising additional questions about the accuracy of China Fire’s public disclosures. We also noted that the company had never reported the death of its founder, former chairman and largest shareholder Ganjin Li. Earler SEC filings showed that he had sole or joint ownership of 57 percent of China Fire’s outstanding shares. After Li’s death, China Fire failed to disclose whether those shares were transferred to his heirs or other parties, or whether any of the recipients became holders of 5 percent or more of the company’s stock, or boosted their existing stakes.

SinoCoking Coal and Coke Chemical Industries Inc. (Sept. 13, 2010)

Our follow up story on SinoCoking (formerly Nasdaq: SCOK) and its stock gyrations found that at least eight of the U.S.-based investors who had participated in a private placement at the time of its reverse merger had been the subject of SEC actions or criminal prosecutions. The case against one was pending at the time and later dismissed. We took a fresh look recently at the registration statement covering the resale of the shares and warrants issued in SinoCoking’s 2010 placements and discovered that six other investors later were charged by the SEC with fraud or other violations. That list includes a hedge fund manager and a stock broker who allegedly participated in wrongdoing involving another Chinese-reverse merger company, China Yingxia International Inc. (formery Nasdaq: CYXI). The SEC complaint said those violation included the time period in which they were investors in SinoCoking. The two settled without admitting or denying guilt, and agreed to pay more than $1.2 million in disgorgement, penalties and interest. We noted that four other shareholders were part of a group charged by the SEC in September 2018 for allegedly orchestrating “pump-and-dump” schemes at three U.S.-based companies, generating more than $27 million in illicit proceeds. All four have reached settlement agreements. The group includes financier Barry C. Honig — who has appeared frequently in Sharesleuth investigations — as well as his longtime business partner, Michael H. Brauser, and a Liechtenstein-based hedge fund called Alpha Capital Anstalt SA.

The Man on the Podium (Jan. 13, 2011)

Our investigation revealed the hidden presence of a Canadian middleman, S. Paul Kelley, in 11 reverse-merger deals in which Chinese companies gained listings on U.S. markets. That list included Telestone Technologies (formerly Nasdaq: TSTC), the subject of an earlier Sharesleuth report, as well as Kandi Technologies Group Inc. (Nasdaq: KNDI), which would become the subject of several subsequent reports. Our investigation, based partly on Canadian court documents, showed that a Kelley-backed entity called Winner International Group Ltd. paid the legal, accounting, public relations and other expenses for Telestone, Kandi and two additional companies, in advance of their reverse mergers and for as many as two years afterward. Winner International got big blocks of stock in those companies in return. None of those financial arrangements, which amounted to $2 million to $3 million per company, was disclosed in SEC filings. An accounting showed that Winner International transferred at least $11.4 million from a brokerage account that held shares in the Chinese companies, and still had stock worth a further $9.4 million as of February 2010. The SEC charged Kelley and four other defendants in 2014 with fraud in connection with two of the most recent reverse-merger deals. The complaint also alleged that some members of the group engaged in fraud through the manipulative trading of Kandi’s shares. All five of the defendants settled the charges against them, and either agreed or were ordered to pay roughly $15 million in disgorgement, penalties and interest.

Kandi Technologies Corp. (May 2, 2011)

Our initial investigation into Kandi (Nasdaq: KNDI) found that it appeared to have greatly overstated the number of electric cars it had sold in the United States. Although the company claimed in SEC filings to have sold 3,700 of the vehicles in America, our survey of dealers, distributors and others familiar with the market showed that the actual number was less than 1,000. For example, we found that although Kandi claimed to have taken orders for 1,200 of its electric cars in Oklahoma alone in 2009, buyers claimed tax credits for only 328 vehicles. Kandi’s main U.S. distributor was a California company headed by the son of Kandi’s founder and chief executive. The discrepancies were a potential problem for the company because it had sold $26.6 million in two private placements that relied partly on representations about the progress of its electric car business. Kandi’s shares traded as high as $7.25 in November 2010, but were down to $2.75 by the time we published our report. The stock later rebounded, ultimately reaching a high of almost $18 a share. The SEC opened an investigation into Kandi in 2013, but the agency’s enforcement staff ended the probe in 2015 without recommending charges. The company’s shares currently trade for around $2.50.

Rockwell Medical Inc. (June 20, 2012)

Our second investigation into Rockwell Medical (Nasdaq: RMTI) focused on a recently ousted executive’s claims that the company and its CEO, Robert L Chioini, knowingly issued false and misleading press releases, and violated other securities laws. The allegations were made in a wrongful termination suit filed by Dr. Richard C. Yocum, the company’s former chief medical officer. He said that Rockwell retaliated against him because he repeatedly warned Chioini that statements he was making about clinical trials on a new anemia treatment for dialysis patients were overly optimistic, to the point of including things that directly contradicted what Yocum had told him. Yocum also alleged that Rockwell had misled the FDA. A judge eventually dismissed his suit, ruling there was an “absence of evidence” that the doctor’s firing was the result of whistleblower-type activity, which could have protected him from retaliation. The FDA later gave its approval to the anemia treatment, but Rockwell Medical has struggled to develop a market for it. The company’s board fired Chioini in May 2018, and also fired the chief financial officer, after a clash of public messages from both sides. Chioini and the CFO ultimately received $1.5 million in severance payments as part of a deal ending litigation over the matter.

Small Companies, Big Questions (Dec. 23, 29, 31, 2012)

Small Companies, Big Questions (Dec. 23, 29, 31, 2012)

This series following up on our original investigation into S. Paul Kelley’s 11 Chinese reverse-merger deals took an in-depth look at what happened to the shares that were issued in those deals, as well as the existing shares held by owners of the shell companies. Among other things, we found that tens of millions of shares that were purportedly held by the insiders at the shell companies essentially disappeared – sold or transferred to others with little, if any, disclosure. We also found that millions of additional shares in the shells also wound up elsewhere. We found that in one deal – the merger that brought Kandi Technologies public – people listed in regulatory filings as shareholders in the shell were unaware they ever owned stock, or were unaware of what became of their stock. We also found that in most of the deals, someone hired promoters to tout the companies at the same time that the hidden recipients appeared to be selling. Finally, we looked at specific time periods and found evidence of behind-the-scenes efforts to manipulate share prices and trading volume and create the appearance of greater investor interest. Many of the activities we spotlighted were beyond the SEC’s three year statute of limitations; the charges that the agency brought in 2014 against Kelley, two more investors and two stock promoters focused on two of the more recent reverse-merger companies, China Auto Logistics Inc. (formerly Nasdaq: CALI, now OTC: CALI) and Guanwei Recycling Corp. (Formerly Nasdaq: CALI, now OTC: GPRC). All of the defendants settled with the SEC, and agreed to payments roughly $15 million in disgorgement, penalties and interest. China Auto Logistics’ stock traded for $6.25 in early 2010, but was down to 50 cents at the time we published our findings. Its shares currently trade for a few pennies, even after accounting for a one-for-six reverse split in 2012. Guanwei Recycling’s stock peaked at $5.70 in 2010, and were down to $1.80 at the time of our report. The company stopped filing reports with the SEC after the fraud case was filed, and its registration was revoked in 2016.

Southern USA Resources Inc. (Jan. 29, 2013)

Southern USA Resources (formerly OTC: SUSA) said it was developing a gold mine in Alabama, a state that had no commercial gold production in decades. The company, which had recently gone public through a reverse merger, was the subject of a lavish promotional campaign with a stated budget of $900,00. That was many times more than the value of Southern USA’s cash and other assets. We noted similarities to the touting of Mesa Energy Holdings, the subject of a prior Sharesleuth investigation. And we found that an entity headed by Samuel DelPresto, a convicted felon who was among Mesa Energy’s biggest shareholders, also provided financing to Southern USA Resources. He later would be charged by the SEC and the Department of Justice in connection with fraud schemes involving Mesa Energy and other companies. Another of the funders was Alpha Capital Anstalt SA, a European investment fund that was charged by the SEC in September 2018 in connection with alleged pump-and-dump schemes that generated more than $27 million in proceeds. The SEC quickly halted trading in Southern USA Resources, citing questions about the accuracy of public statements to investors, and information in the direct-mail promotional flyers. The agency brought fraud charges against the company and its chief executive, Charles H. Merchant Sr., alleging that they made false statements. The SEC’s complaint also said that Merchant caused Southern USA Resources to issue nearly 4.9 million purportedly unrestricted shares to its noteholders, with opinion letters from its corporate counsel that the shares were free to trade. The SEC said Merchant also sold more than 3.7 million shares of his stock to four buyers associated with Southern USA Resources’ corporate counsel, including the counsel’s wife and two employees of his firm. Although the complaint did not identify that attorney, other filings made clear that it was Darren L. Ofsink. He was later charged by the SEC and DOJ in connection with a market-manipulation scheme involving another company, CodeSmart Holdings Inc. (formerly OTC: ITEN), shortly after the Southern USA Resources promotion. He pleaded guilty to one count of conspiracy to commit securities fraud and was scheduled to be sentenced in May 2020.

Kandi Technologies Group Inc. (April 22, 2013)

This follow up to our previous investigation on Kandi’s reported electric car sales used U.S. customs records to reinforce our findings that the company greatly exaggerated the number of vehicles it delivered to America. Those records showed that even though Kandi (Nasdaq: KNDI) claimed to have sold 4,600 cars here from 2009 through 2011, only about 1,100 came through U.S. ports in that time period. That was significant because the car sales accounted for a sizable portion of its revenue and earnings. Kandi had reported in SEC filings that it sold 1,141 electric cars in America in the first nine months of 2009. That favorable news sent the company’s share price sharply higher, producing a one-month gain of more than 50 percent. However, our check of customs records show that, contrary to Kandi’s statements, only 203 of Kandi’s cars were delivered to the United States in that period, and only 143 arrived in the final quarter of 2009. We found similar differences in Kandi’s claims for 2010 and 2011 as well. As we mentioned previously, the SEC opened an investigation into the company but ended it with no charges. Kandi’s shares closed at $3.83 the day before our story appeared. They currently trade for around 30 percent less than that.

The Curious Touting of Kandi Technologies (July 10, 2013)

This investigation documented elaborate effort to tout shares of Kandi (Nasdaq: KNDI) and certain other companies through social media outlets, including Twitter and Yahoo’s stock message boards. We identified a pattern of postings, on multiple sites under multiple user names, that suggested a coordinated effort. We noted that some of the posters touting Kandi on Yahoo’s message boards also were posting about another Chinese company, Renren Inc. (NYSE: RNRN), and the National Bank of Greece (OTC: NGBIF). At least six other accounts on Twitter also began posting about Kandi, with a common set of messages. They, too, touted Renren and the National Bank of Greece. Kandi’s stock more than doubled in the early stages of the touting going from just under $4 a share on June 4, 2013 to $8.50 on June 11. Two weeks later, after another wave of touting, Kandi raised $26.4 million in a private placement, at $6.03 a share. We noted that many of the posters systematically deleted their tout messages, or deleted their accounts entirely. The ones involved in the second wave of posting also touted three additional stocks – Gevo Inc. (Nasdaq: GEVO), Emerald Oil Inc. (formerly AMEX: EOX) and Samson Oil and Gas Ltd. (OTC: SSNYY). Although our investigation did not delve into the business operations of those companies, Renren or National Bank of Greece, we considered the systematic touting to be a major red flag. The shares of all of those companies have dropped significantly since our story appeared. One of them, Emerald Oil, filed for bankruptcy in 2016.

Virtual Piggy Inc. (Sept. 23,2013)

Virtual Piggy (formerly OTC: VPIG) operated an e-commerce platform designed to give young people a safe way to make online purchases, and to learn financial management by tracking their spending, saving and charitable giving. But our investigation found that the company’s biggest shareholder was the brother of two men who were described by federal authorities as organized crime figures. One was in prison at the time our story appeared, and the other was under indictment for a fraud involving another public company. He also was sentenced to prison. In addition, we found that a barred brokerage executive named Howard M. Appel, who had served prison time in connection with a stock-manipulation case, was key consultant to Virtual Piggy – despite still being on supervised release for that crime. Virtual Piggy’s stock tripled in the first five months of 2013, to a high of $3.23. That gave the company a market capitalization of $350 million, despite the fact that it had only generated $6,000 in revenue since its inception. Our analysis of Virtual Piggy’s SEC filings also turned up other shareholders with links to purported organized crime members or to previous fraud schemes. Tens of millions of shares of Virtual Piggy stock traded hands in 2013, many of them when the price was near its peak, allowing some of the early shareholders to cash out with big gains. The company, now known as Rego Payment Architectures Inc. (OTC: RPMT), has yet to generate more than $50,000 in annual revenue or turn a profit. The SEC and the Justice Department brought fraud charges against Appel in 2018, alleging that he orchestrated schemes to manipulate the shares of Virtual Piggy and Red Mountain Resources Inc. (formerly OTC: RDMP). The SEC case also included a third company, Rio Bravo Oil Inc. (formerly OTC: RIOB). Red Mountain Resources and Rio Bravo Oil had some of the same shareholders as Virtual Piggy. Appel pleaded guilty to one count of conspiracy to commit securities fraud and was sentenced to five years in prison. Rego Payment’s stock current trades for around 20 cents.

Telestone Technologies Corp. (June 17, 2014)

Our followup on Telestone (Nasdaq: TSTC) found that the SEC began sending the company letters in September 2012, asking for detailed information about its sales contracts with customers and its soaring accounts receivables. Telestone’s stock was trading for around $1.40 at the time. The company’s receivables totaled $276 million, an amount equal to 75 percent of its reported revenue for 2009, 2010, 2011 and the first nine months of 2012. The SEC told Telestone in its letters to provide a schedule of all receivables originated in that time period, showing the name of the customer, the date the contract was signed, the amount due, the terms and whether any payments were collected. Telestone did not comply, citing nondisclosure agreements with customers. Instead, it simply submitted a list of receivables by geographic territory, with no additional details. The SEC responded that unless Telestone provided that information, it should restate its 2011 financials and announce that its results from prior years should not be relied upon. Again, Telestone did not do so. The Nasdaq exchange delisted the company after it failed to file its year-end financials for 2012 and its results for the first quarter of 2013. And when it finally did report unaudited figures for 2012, it said revenue fell almost 50 percent, to $58 million, and that it had a loss of $24 million. That was the company’s last submission to the SEC. Its registration was revoked in December 2016.

Kandi: The Return of the Cyber Shills (Oct. 7, 2014)

Our continued monitoring of the touting of Kandi (Nasdaq: KNDI) on social media sites found that when the company’s stock went on another run in the summer of 2014, it was accompanied by a touting campaign that featured dozens of so-called sock puppet accounts. We turned up more than 40 related accounts at StockTwits.com that touted Kandi and certain other companies, and more than 100 accounts at Yahoo.com’s finance page that pushed the same group of stocks. All told, the accounts produced nearly 40,000 comments about Kandi and the other companies. One of the most prolific posters was a stock promoter with a criminal past. We found that many of the same posters either duplicated or amplified his remarks, or responded to them shortly after they appeared – even in the middle of the night. Kandi’s stock rose from $14 in early July of 2014 to a high of $22.49 on July 22, aided by a steady stream of positive press releases and the bullish posts on social media. The next month, the company raised $71 million by selling additional stock. When we started contacting some of the posters to ask about their activity, they either deleted their accounts or changed their screen names and avatars. We noted that the accounts of posters we had not contacted also were deleted or altered– further proof that they were connected to the broader touting effort. Kandi’s stock has fallen dramatically from those high valuations, and now trades for around $2.60.

Kandi: Where are the Go-Karts (Dec. 31, 2014)

After checking Kandi’s reported U.S. car sales against import figures in a previous report and finding significant discrepancies, we decided to do the same thing with its reported exports of go-karts and all-terrains. We found that even though the global economic collapse in 2008 sent the power sports industry into a steep decline, Kandi’s sales figures suggested that it not only bucked the trend but seized a much bigger share of the global market. Kandi (Nasdaq: KNDI) said in SEC filings that it sold more than 177,000 go-karts in its six most recent fiscal years, and that those sales accounted for half its revenue. But import figures showed that only about 30,000 were delivered to U.S. distributors and other big buyers. People in the powersports industry told us that there was no good explanation for where the other 147,000 machines might have gone, since the United States is far and away the world’s biggest go-kart market. Kandi’s SEC filings said most of its go-kart and ATV sales in 2012 and 2013 were to a pair of Chinese companies that resold them to customers in the United States, Europe and other parts of the world. But our check of import records showed no shipments by those companies, or any clear affiliates, to U.S. ports. Although Kandi was the subject of an SEC investigation at the time of our report, it appears the sales discrepancies were not part of the focus. The SEC notified Kandi in 2015 that it was ending its probe without bringing charges.

Pretenders and Ghosts (March 6, 2018)

This investigation built on the work of others who previously documented how certain investor-relations businesses and writers-for-hire were secretly being paid to produce favorable stories about public companies that were posted on SeekingAlpha.com and other sites. Posting tout articles without disclosing compensation is a violation of SEC rules. We identified more than 60 writers, some real and some imaginary, whose bylines appeared on nearly 600 “stealth promotion’’ stories about companies backed by financier Barry C. Honig and his associates, including longtime business partner Michael H. Brauser and Dr. Philip Frost, chairman and chief executive of Opko Health Inc. (Nasdaq: OPK) We also spotlighted two websites, MarketExclusive.com and SmallCapExclusive.com, that were connected to an investor relations consultant and erstwhile stock promoter whose ties to Honig went back more than a decade. We found that those sites posted dozens of stories about Honig-backed companies, and that most were attributed to fictitous writers whose biographies were made up and whose purported head shots were lifted from LinkedIn.com and other commercial sites. The investigation also found that some of the same writers also produced numerous promotional stories about clients of IRTH Communications LLC. That list included Vuzix Corp. (Nasdaq: VUZI), 22nd Century Group Inc. (Nasdaq: XXII) and Citius Pharmaceuticals Inc. (Nasdaq: CTXR). Although we did not examine the business operations of those companies, the promotions served as a red flag, and the share prices of all of them have plunged since our investigation. The SEC brought fraud charges in September 2018 against Honig, Brauser, Frost and 17 other individual and corporate defendants, alleging they participated in pump-and-dump schemes at three small public companies that generated more than $27 million in proceeds. All three of those companies – Mabvax Therapeutics Holdings Inc. (formerly Nasdaq: MBVX), MGT Capital Investments Inc. (OTC: MGTI) and BioZone Pharmaceuticals Inc. (now Cocrystal Pharma Inc., Nasdaq: COCP) – were the subject of stealth promotion stories produced by the network of writers we identified. The SEC complaint mentioned that the use of stealth promotional pieces was part of each scheme. It said that one of the defendants, a Honig lieutenant named John R. O’Rourke, personally sought to manipulate the market for Mabvax’s shares by posting a promotional article on SeekingAlpha under a pseudonym. O’Rourke later became chief executive of another company financed by the group, Riot Blockchain Inc. (Nasdaq: RIOT) It, too, was the subject of stealth promotion stories. Honig, Brauser, Frost, O’Rourke and all but one other defendant have settled, or agreed to settle, the SEC charges against them. Court filings also have mentioned a Justice Department investigation, which suggests that criminal charges still could be filed against some or all of the defendants.

Cool, Mara Riot Part 1 (July 12, 2018)

This investigation took a detailed look at the financing transactions, share issuances and share sales at three of the companies that were bankrolled by financier Barry C. Honig and his associates, and touted through the “stealth promotion” stories we documented in our previous report. We showed how Honig and the others provided millions in capital to two of the companies, PolarityTE Inc. (Nasdaq: PTE, formerly Nasdaq: COOL) and Riot Blockchain Inc. (Nasdaq: RIOT), then orchestrated the return of most of that money through special dividends, while still retaining the shares they received for the initial contributions. They dumped many of those shares as PolarityTE and Riot Blockchain rose to new, promotion-fueled highs. Our analysis showed that Honig personally sold at least $30 million of stock in PolarityTE and Riot Blockchain from August 2017 through December 2017 without promptly reporting the sales, as required of non-passive investors holding 5 percent or more of a company’s shares. We also found that Honig and his associates had undisclosed ownership interests in several Bitcoin-related businesses that were acquired, or supposed to be acquired, by Riot Blockchain and another company, Marathon Patent Group Inc. (Nasdaq: MARA). We calculated that members of the group sold $77 million to $108 million of stock in PolarityTE, Riot Blockchain and Marathon Patent between June 2017 and February 2018. That group included two of Honig’s longtime lieutenants — John R. Stetson, who had been installed as chief financial officer at PolarityTE, and John R. O’Rourke, who was elevated to chief executive of Riot Blockchain. The SEC brought fraud charges in September 2018 against Honig, Stetson, O’Rourke and 17 other individual defendants, alleging that they functioned as an undisclosed control group and orchestrated pump-and-dump schemes at three other companies. The SEC also initiated investigations at PolarityTE and Riot Blockchain, focusing in part on their dealings with Honig’s group. Both companies announced this year that the SEC ended the probes without charges. Honig and other members of his group, including former PolarityTE CFO John R. Stetson and former Riot Blockchain CEO John R. O’Rourke have agreed to settle the charges against them, without admitting or denying guilt. The final financial terms have yet to be established.

Cool, Mara Riot Part 2 (Sept. 25, 2018)

The second part of our investigation into PolarityTE (Nasdaq: PTE), Marathon Patent (Nasdaq: MARA) and Riot Blockchain (Nasdaq: RIOT) looked at the parallels between Honig group’s actions at those companies and the allegations in the SEC’s pump-and-dump case. We found that all of the deals featured a common set of players, and common strategies for getting around SEC disclosure requirements on shareholdings and share sales. We also showed that most of Marathon Patent and Riot Blockchain’s acquisitions, investments or partnerships were with entities in which Honig and his associates had hidden stakes, or whose key players had prior relationships with them. PolarityTE’s stock peaked at $41.22 in June 2018. It now trades for around $1. Riot Blockchain’s stock peaked at $46.20 in December 2017. It now trades for a little over $1. Marathon Patent’s stock reached a high of $10.18 in November 2017. It now trades for around 50 cents, after a 1-for-4 reverse split.

Marathon Patent Group Inc. (May 13, 2019)

Our investigation into Marathon Patent (Nasdaq: MARA) took an even closer look at the share transactions from early 2017 to early 2019. We found that members of Honig’s group converted notes, warrants and preferred stock into common shares, then sold them for upwards of $27 million, apparently without proper SEC disclosure. Marathon Patent, by comparison, had just over $2 million in revenue in that period, and more than $44 million in losses. Most of the stock went to John O’Rourke, a Honig associate who for part of the period was the CEO of a rival company, Riot Blockchain Inc. (Nasdaq: RIOT). O’Rouke was listed as the manager of a limited partnership that provided $5.3 million in financing to Marathon Patent in late August 2017, shortly before it pivoted from an intellectual property licensor to a bitcoin producer. The partnership got notes convertible to preferred stock, at a price of 80 cents a share, plus warrants for additional shares at $1.20. Marathon Patent’s stock shot to a high of $10.03 a share in November 2017, after the company announced it was acquiring a recently formed bitcoin miner called Global Bit Ventures Inc. Later SEC filings showed that another entity managed by O’Rourke was one of the main funders of that company, and stood to get millions of additional shares in the merger. Marathon Patent ultimately cancelled the deal because of deteriorating market conditions, but not before O’Rourke and other members of the Honig group cashed out of most of their holdings. We found that most of those sales occurred while O’Rourke, Honig and other members of the group were under SEC investigation for alleged pump-and-dump schemes at three other companies. The last sales came just a few weeks before they were charged. Marathon Patent’s stock currently trades for around 50 cents a share, after a reverse split in April 2019.

U.S. Gold Corp. (July 31, 2019)

We noted that U.S. Gold Corp. (Nasdaq: USAU), a company that went public through a reverse merger arranged by financier Barry C. Honig and some of his associates, had added former Interior Secretary Ryan Zinke to its board of directors. U.S. Gold also gave Zinke, who had resigned from the Trump administration amid multiple ethics investigations, a consulting contract worth $90,000. U.S. Gold played up Zinke’s ties to Trump, featuring him in an investor presentation titled “Making American Mining Great Again.’’ The company’s stock rose 50 percent in the first six weeks after Zinke’s appointment, reaching a high of $1.53 on May 21. The following month, U.S. Gold sold $2.5 million in new preferred stock, at a conversion price of $1.14. As we noted, even without that extra capital, U.S. Gold lacked the financial resources to complete its exploration program, much less begin mining. We also noted that the company’s two top executives had long histories with Honig, each having been involved in more than a dozen companies with him. U.S. Gold’s chief operating officer, David S. Rector, had been an officer or director of four other publicly traded mining companies backed by Honig, none of which ever produced a single dollar of revenue or a single ounce of commercial gold, silver or copper. U.S. Gold’s stock ended last year at 81 cents, and was down to 39 cents on March 19. The company then executed a 1-for-10 stock split to lift the price above $1 and maintain its listing on the Nasdaq. Its shares now trade for around $5, or a pre-split equivalent of 50 cents.

cbdMD Inc. (Sept. 26, 2019)

cbdmD, formerly known as Level Brands Inc. (formerly Nasdaq: LEVB) marked the return of Martin A. Sumichrast, who was featured in some of our earliest investigations. Sumichrast was the founder and chief executive of Level Brands, which went public in 2017 and functioned mainly as a licensing and marketing vehicle for ex-supermodel Kathy Ireland’s home, fashion and beauty lines. Sumichrast and Ireland had teamed up once before, at House of Taylor Jewelry Inc. In 2006 and 2007, he and certain associates sold millions of dollars of stock they received around the time House of Taylor went public. In 2008, the company went bankrupt and was liquidated. Level Brands was hardly a success either. Its annual financial report for 2018 showed that more than half of the $12.9 million it listed as revenue in 2017 and 2018 came in the stock of other companies. Declines in the value of those shares forced Level Brands to book more than $4.2 million in unrealized losses, reversing its prior claims of profitability. In late 2018, Level Brands agreed to acquire a company that makes and markets cannabinoid oils, lotions, tinctures, bath bombs and pet products. Sumichrast and two of Kathy Ireland’s partners sold most of their shares in early 2019 for a little more than $6 million. However, an SEC filing showed that Sumichrast had a side deal with the majority shareholder of the cbd business, giving him the right to receive as many as 2.1 million additional shares, for just $90. He already has been credited with at least 787,500 shares, which vest over time. The company has been relying on sponsorship deals with prominent athletes to attract attention to its brand. They include pro golfer Bubba Watson, Olympic track and bobsled athlete Lolo Jones, and others who have been outspoken about their Christianity. We found that cbdMd did not disclose that its main shareholder and co-CEO also operates the Adult Entertainment Broadcasting Network, which offers streaming porn to subscribers, and also produces its own videos. cbdMd’s shares reached $7.24 last May, just before it announced a stock offering at $6. The company’s shares are currently trading for around 85 cents, down almost 90 percent from their peak.