Marathon Patent Group Inc.’s latest financial reports provide new details on suspect securities transactions by financier Barry C. Honig and his associates, and raise more questions about the company’s activities and disclosures.

Marathon Patent’s (Nasdaq: MARA) 10-K filing with the Securities and Exchange Commission in March listed all of the dates on which members of Honig’s group converted notes, warrants and preferred stock into common shares.

Sharesleuth’s analysis found that members of that group wound up with almost 11.9 million shares, which they likely sold for $26 million or more. Those transactions took place between September 2017 and August 2018.

Most of that stock appears to have gone to a limited partnership managed by John R. O’Rourke III, a longtime Honig lieutenant and the former chairman and chief executive of Riot Blockchain Inc. (Nasdaq: RIOT).

O’Rourke and Honig were among 10 individuals charged by the SEC last September in connection with alleged pump-and-dump schemes at three other small public companies. The SEC asserted in its complaint that Honig was the “primary strategist” of those schemes, which generated more than $27 million in proceeds from 2013 to 2016.

The ownership tables in Marathon Patent’s proxy statements and annual filings never listed the limited partnership managed by O’Rourke — Revere Investments LP — among its top shareholders. And the company’s filings mentioned that entity by name just once after 2017, even though Revere (and perhaps some unidentified affiliates) later got at least 9.2 million common shares through the conversion of notes and preferred stock.

Those shares represent more than a third of the total now outstanding.

Similarly, Revere never filed anything with the SEC acknowledging ownership of 5 percent or more of Marathon Patent’s stock. That suggests that Revere (and possibly some affiliates) sold the shares almost immediately upon receiving them via the conversions — as part of a strategy to avoid triggering disclosure requirements.

Marathon Patent declined to answer our questions about its dealings with O’Rourke and other members of Honig’s group, and about whether management raised any objections to the manner in which the notes and preferred stock were converted.

Sharesleuth previously reported on the Honig group’s hidden activities at Marathon Patent in a two-part series last year (see the stories here and here).

Those articles also analyzed unusual share transactions at two more companies, Riot Blockchain and PolarityTE Inc. (Nasdaq: COOL). Both have disclosed that they are the subjects of SEC investigations.

Marathon Patent’s 10-K filing and 10-Q filing did not include any mention of an SEC inquiry or subpoena.

Marathon Patent’s shares followed a similar trajectory to those of the companies at the heart of the September pump-and-dump case — Mabvax Therapeutics Holdings Inc. (OTC: MBVXQ); MGT Capital Investments Inc. (OTC: MGTI) and BioZone Pharmaceuticals Inc., now Cocrystal Pharma Inc. (Nasdaq: COCP).

All had temporary surges in their share price and trading volumes, which the SEC says were aided by promotional campaigns and manipulative trading.

Marathon Patent’s stock shot from just under $2 on Nov. 1, 2017 to just over $10 on Nov. 27, 2017, largely because its deal to acquire a brand new bitcoin-mining company called Global Bit Ventures Inc. caught the attention of investors seeking cryptocurrency plays.

The two companies repeatedly delayed the closing of their merger, and finally called it off last summer, citing a general weakness in the bitcoin market. By that time, Marathon Patent’s stock price was down to $1 a share.

Marathon Patent’s 10-K filing shows that it generated only $2 million in total revenue in 2017 and 2018, and had more than $43 million in losses.

The company said in a quarterly financial report last week that it had $230,694 in revenue — all from currency mining — for the three months that ended March 31, and a further $1 million in losses.

Our analysis of share transactions suggests that, since mid-2017, members of Honig’s group collected:

- Nearly $17 million by converting notes into common stock and selling the shares into the market.

- Around $8.5 million by converting preferred stock into common stock and selling the shares into the market.

- Between $700,000 and $1.6 million by exchanging warrants for common stock and selling the shares into the market.

The group’s original investment in those securities was somewhere between $5 million and $6 million.

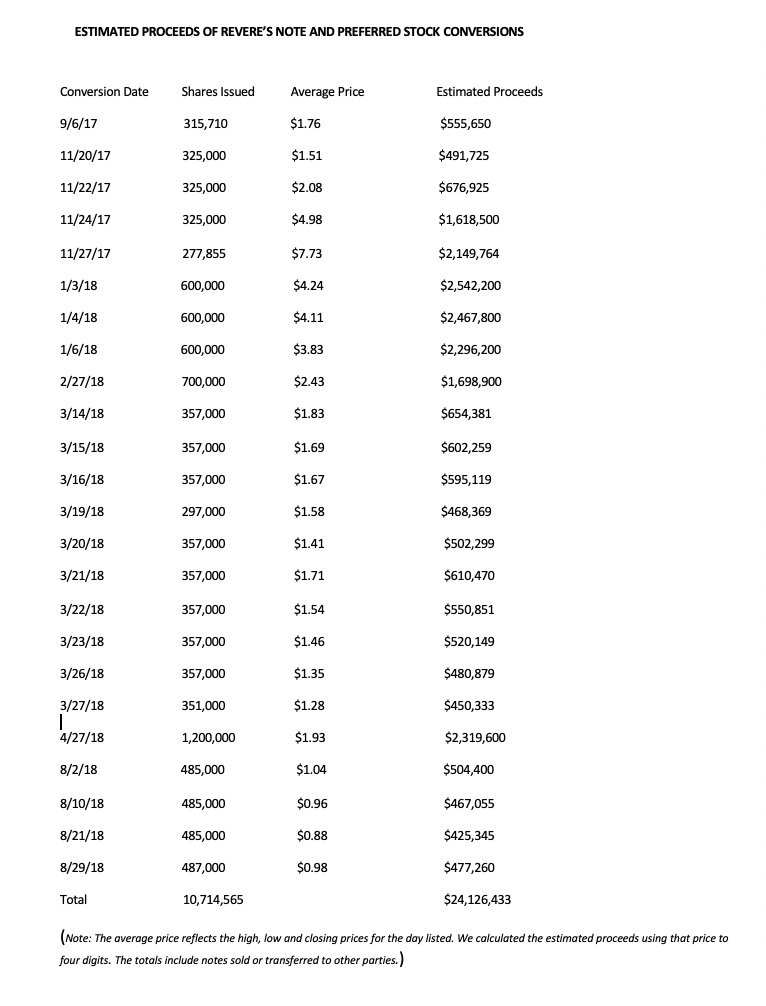

Our calculations of the proceeds assume that the recipients sold the most of the stock upon receiving it. For the price per share, we used the average of the high, low and closing prices on the conversion dates, or the next available trading day.

Marathon Patent’s quarterly financial report shows that the limited partnership managed by O’Rourke still had almost $1 million in unconverted notes as of March 31. The underlying stock had a market value of $910,000 at last Friday’s closing price.

UNREPORTED SHARE ACQUISITIONS

Our analysis of the share issuances listed in Marathon Patent’s 10-K filing found that on multiple occasions, the holders of notes or preferred stock converted them into large amounts of common stock without disclosing the acquisition of 5 percent or more of the company’s shares. For example, Marathon Patent said it issued 975,000 common shares in three equal note conversions, on Nov. 20, Nov. 22 and Nov. 24, 2017. The company’s share price more than tripled in that same week, to a high of $6.04.

Although the 975,000 shares amounted to 10 percent of the company’s total outstanding after the conversions, no one filed an SEC form reporting ownership of that stake. That suggests that Revere either ignored the disclosure rule, immediately sold shares to stay below the 5 percent threshold, or distributed notes to other parties prior to conversion.

Marathon Patent’s price peaked at $10.04 on the next trading day — Nov. 27, 2017 — when a further 277,855 shares were issued through a fourth note conversion.

The 1.25 million shares issued during the surge could have been sold for at least $4.9 million, and perhaps as much as $6.4 million, based on the trading ranges for those dates.

Similarly, Marathon Patent’s 10-K shows that it issued 1.8 million shares — also in three equal note conversions — on Jan. 3, Jan. 4 and Jan. 6, 2018. That amounted to well over 10 percent of the total outstanding afterward. If the newly issued shares were sold on those same dates, the proceeds would have been around $7.3 million.

The report also shows that Marathon Patent issued 3.5 million shares in March 2018 through the conversion of preferred stock. Those transactions were spread over 10 consecutive trading days, from March 14 to March 27.

We estimate that those shares — which amounted to 18 percent of the company’s total outstanding at the time — could have been sold for around $5.4 million, based on average of the high, low and closing prices for those days.

The following week, Marathon Patent announced that it had revised the terms of its merger with Global Bit Ventures downward and delayed the closing. It cited “material changes” in both companies’ operations.

SEC filing show that O’Rourke also was one of the biggest backers Global Bit Ventures. And Global Bit Ventures’ chief executive doubled as head a second digital currency company, BTCS Inc. (OTC: BTCS) that was financed by Honig and his associates.

That raises questions about how much, if anything, members of Honig’s group knew about the looming changes in the Marathon Patent-Global Bit Ventures deal at the time that Revere was selling a large chunk of its holdings.

Marathon Patent’s 10-K filing shows that it issued 1.2 million shares on a single day last April, for the conversion of $960,000 in notes. Those shares amounted to roughly 6 percent of the total outstanding after the transaction.

Once again, no one filed a disclosure form with the SEC reporting ownership of that stake, which could have been sold for more than $2.3 million at the time.

All of the notes and preferred stock converted in the above transactions originally were issued to Revere Investments. Marathon Patent said in SEC filings that O’Rourke had sole voting and investment authority over Revere’s holdings.

O’Rourke’s ties to Global Bit Ventures

Our investigation last year found that O’Rourke was manager of a second entity, Azzurra Holdings LLC, that had convertible notes and preferred stock in Marathon Patent’s intended merger partner, Global Bit Ventures.

Azzurra stood to receive millions of additional shares in the combined company through those deals. We found that Azzurra had acquired part of its interest in Global Bit Ventures from an entity called HS Contrarian Investments LLC.

HS Contrarian purportedly was run by John R. Stetson, another longtime Honig associate who was PolarityTE’s chief financial officer and, for a brief time after that, its chief investment officer. Stetson previously had been an officer of Marathon Patent.

Stetson and HS Contrarian were among the 20 individuals and entities charged in the SEC’s pump-and-dump case. The complaint asserted that Honig actually had a 94 percent ownership interest in HS Contrarian and that Stetson essentially did his bidding.

PolarityTE, which is seeking to commercialize new methods for skin, bone and tissue regeneration fired Stetson on the day the SEC charges became public. He sold much of his stock in that company in late September and early October, collecting $5.5 million.

Our earlier investigation found that two other defendants in the pump-and-dump case, Honig and Frost, sold well over $20 million of PolarityTE stock, most of it in the second half of 2017.

Since then, Honig, Frost and another defendant, Mark E. Groussman, have sold an additional $20 million of PolarityTE stock, if not more.

Our analysis of SEC filings found that Honig also added at least 450,000 PolarityTE shares from mid-March to mid-July of 2018, a period in which the company’s stock price rose from a low of around $16 to a high of $41. The filings do not say when or how he acquired those shares, or whether he bought and sold additional shares in that period.

Like Marathon Patent, PolarityTE has yet to demonstrate that it is financially viable. It had revenue of $1.6 million for the fiscal year that ended Oct. 31, 2018, and posted a net loss of $65.4 million.

It said in a quarterly report last week that it had $1.5 million in revenue for the first three months of 2019, and $25.6 million in losses. Less than $300,000 of that revenue came from PolarityTE’s skin-regeneration business; the rest came from contract research.

PolarityTE, disclosed in its 10-K filing on March 18 that the SEC was looking into its dealings with Honig and certain associates, including Stetson.

PolarityTE said the SEC subpoena also sought information about the performance of its SkinTE product, about its communications with regulators about SkinTE and about any promotion of the company’s stock.

(Disclosure: Chris Carey, editor of Sharesleuth.com, does not invest in individual stocks and has no position in the shares of any company mentioned in this story. Mark Cuban, owner of Sharesleuth.com LLC, has a short position in PolarityTE.)

A DEAD STOCK COMES BACK TO LIFE

Despite the buzz that Marathon Patent’s bitcoin aspirations generated, the mining business itself has been a failure.

The company was down to $2.3 million in cash at the end of the first quarter, and said in its quarterly filing that it was uncertain whether that would be enough to fund its operations for the next 12 months..

Marathon Patent wrote down the value of its bitcoin miners by more than 40 percent last year. SEC filings show that it paid $5.1 million for 1,400 Antminer S9 units in early 2018.

Marathon Patent’s stock sank along with bitcoin prices in the first half of 2018. It fell even further in the second half, going from $1 a share to less 50 cents a share last summer after the Global Bit Ventures deal collapsed.

Its shares still were trading toward the bottom of that range at the end of March, and the company was in danger of losing its Nasdaq listing.

Marathon Patent executed a 1-for-4 reverse split on April 8, lifting its share price to $2.77 — well above Nasdaq’s minimum standard. On the 10th, the company’s stock moved sharply higher, almost reaching $4.

Since then, Marathon Patent’s shares have risen and fallen with bitcoin prices. They closed Friday at $2.92, giving the company a market capitalization of $18.6 million.

LINKS BETWEEN MARATHON PATENT AND RIOT BLOCKCHAIN

Marathon Patent and Riot Blockchain announced on successive days in November 2017 that they were acquiring brand new bitcoin-mining companies, through stock transactions initially valued at $197 million.

As we previously reported, Honig and some of his associates — including several co-defendants in the SEC case — were among the biggest investors in the two bitcoin companies. That fact that was not disclosed at the time.

They also were among the top investors at Marathon Patent and Riot Blockchain, through a combination of shares, convertible notes and warrants.

O’Rourke became chairman and chief executive of Riot Blockchain after its bitcoin acquisition. He resigned from those posts last September, after being charged in the pump-and-dump case.

According to the amended complaint that the regulatory agency filed earlier this year, O’Rourke and entities under his control received roughly $1.5 million from those alleged schemes.

O’Rourke’s involvement with Marathon Patent, through the financing provided by Revere, predated his elevation to CEO at Riot Blockchain.

Marathon Patent got $5.3 million from Revere in August and September of 2017, shortly before its pivot from an intellectual-property licensor to a bitcoin miner. It gave Revere convertible notes and warrants in return.

Those securities ultimately became the equivalent of 11.8 million common shares.

FAVORABLE EXCHANGE DEALS

Other people with ties to Honig got a little more than 1 million Marathon Patent shares through a pair of exchange agreements a few months before the company made its move into the bitcoin business.

Two Honig-related investors got almost 400,000 Marathon Patent shares in September 2017 through the exchange of warrants they bought from a pair of investment funds. The warrants had been issued in a $2.7 million private placement earlier that year, at an exercise price at wound up being well above Marathon Patent’s market price.

For reasons the company never explained, it agreed in mid-July of 2017 to exchange them for common stock with a market value of $700,000. SEC filings show that Groussman bought a third of the warrants from one of the original investors and got 199,500 shares in the exchange (adjusted for a previous 1-for-4 reverse split in late October 2017).

A New Jersey doctor whose daughter is married to Honig’s brother, Jonathan Honig, also got 199,500 shares. SEC filings show that an investment fund headed by Jonathan Honig was among Riot Blockchain’s biggest shareholders.

The 399,000 shares could have been sold for $700,000 when they were issued in early October 2017. They could have brought $1.6 million, or more, when Marathon Patent’s shares peaked the following month.

Our previous investigation found that Marathon Patent also gave the undisclosed holder of a $500,000 convertible note issued in a Honig-arranged financing in 2014 a much more favorable conversion rate as the bitcoin deal neared.

The holder got preferred stock that was convertible to 628,000 shares of common stock, as opposed to the16,667 shares that would have been issuable under the original note deal (both numbers adjusted to reflect the reverse split in the fall of 2017).

Marathon Patent’s filing showed that it issued the common shares in three separate transactions, in August and September of 2017. Our analysis suggests that the recipient likely sold them at the end of that period, during a spike in the company’s stock price and trading volume. If that is correct, those sales would have generated around $1.2 million.

Marathon Patent said in a registration statement that Revere sold $224,284 of its notes on Nov. 27, 2017 to Hudson Bay Master Fund Ltd., a hedge fund that has invested alongside Honig and his associates in numerous other companies.

That dollar amount is within $2,000 of the value of notes converted on that date. We estimate that the shares issued in the transaction could have been sold for $2.1 million or more. We included those proceeds in the total for Honig’s group because of Hudson Bay’s longstanding ties to the financier and his associates. Among other things, Hudson Bay played a key role in arranging their initial investment in Mabvax.

WARRANTS BECOME PREFERRED STOCK

Revere’s convertible-note deal with Marathon Patent also gave it 6.6 million warrants, exercisable at 80 cents each. In December 2017, the company replaced them with preferred stock, which were exchangeable for 5.5 million common shares.

Revere converted nearly two-thirds of that preferred stock between March 12, 2018 and March 27, 2018. Marathon Patent’s 10-K filing shows that Revere collected an average of 350,000 shares per day for 10 straight trading days.

Although the number of shares it received equaled 18 percent of Marathon Patent’s total outstanding after the conversions, neither Revere nor any other party filed anything with the SEC disclosing ownership of 5 percent or more of the company’s shares.

That means Revere either failed to properly report its ownership, sold shares right after each conversion to get around disclosure rules, or distributed some of the preferred stock to other recipients prior to conversion.

Marathon Patent’s share price fell by a third in the time that Revere was converting that preferred stock into common and, presumably, selling the shares. The decline was partly due to a drop in bitcoin prices. But the lack of disclosure surrounding the share transactions meant ordinary investors had no idea Revere was liquidating those holdings.

Marathon Patent’s 10-K filing shows that the last of Reverse’s preferred shares were converted into 1.94 million common shares in August 2018, after the merger with Global Bit Ventures fell apart. The new shares were issued in four nearly equal installments, on Aug. 2, 10, 21 and 29. If they were sold immediately, the proceeds would have topped $1.8 million, based on the average of the high, low and closing prices for those dates.

The last conversion was a little more than a week before the SEC brought charges against Honig, O’Rourke, Stetson, Groussman, Frost and others, including Michael H. Brauser, who has created and/or financed companies alongside Honig for nearly a decade.

Frost settled the charges against him in December, paying $5.5 million in disgorgement, penalties and interest. Opko, which also was charged but did not appear to benefit from any share sales, paid a $100,000 settlement.

Groussman settled with the SEC in February, agreeing to pay just over $1 million in disgorgement, penalties and interest.

Another defendant, a Lichtenstein-based hedge fund called Alpha Capital Anstalt, also settled with the SEC. It agreed to pay a little more than $900,000.

THE HONIG GROUP’S TIES TO GLOBAL BIT VENTURES

Marathon Patent’s original deal for Global Bit Ventures called for the latter company’s owners to receive 126 million common shares, which would have had a market value of more than $180 million on the day it was announced.

When the two companies revised their agreement in April 2018, they reduced the total consideration to 70 million shares. Marathon Patent’s filing included a copy of the revised merger agreement, along with charts showing how many shares each of the holders of Global Bit Ventures’ stock and notes would get.

The charts had not been included in the original merger filing five months earlier. They showed that O’Rourke’s Azzurra Holdings stood to receive the equivalent of 20.5 million common shares under the revised agreement.

The charts showed that two entities controlled by Brauser were to get just over 260,000 shares in the deal. The last page of the filing was a list of agreements related to the merger. One was labeled “Purchase Agreements in connection with Company Debt between the Company and each of Barry Honig, Deane Gilliam, HS Contrarian Investments LLC and Northurst Inc.”

The designation “Company” in that document referred to Global Bit Ventures. The language suggested that Honig and HS Contrarian were among the original purchasers of Global Bit Ventures’ convertible notes prior to the merger agreement. It appears that they transferred the notes to Azzurra, which was listed elsewhere in the filing as one of the four ultimate holders, along with Gilliam, Northurst and another entity.

The filing on the revised merger showed that Azzurra held $1.75 million in Global Bit Ventures notes. It was to get preferred stock equal to 5.7 million Marathon Patent shares in exchange.

The filing showed that Azzurra also had preferred stock in Global Bit Ventures that would become 14.8 million common shares of the combined company.

Northurst was an investor in Riot Blockchain as well, having bought shares and warrants in that company’s private placement in April 2017 – about six months before its move into blockchain and bitcoin. In addition, it was the biggest shareholder in Kairos Global Technology Inc., the upstart bitcoin miner that Riot Blockchain bought in November 2017 for convertible preferred stock with an implied market value of $12.6 million.

Marathon Patent announced last June that the closing date on the revised merger agreement had expired and would not be extended. It said going forward with the deal in the face of a steep decline in bitcoin prices was not in the best interest of shareholders.

Marathon Patent issued 3 million of its shares to Global Bit Ventures as a breakup fee. That was the equivalent of 12.5 percent of Marathon Patent’s outstanding shares.

Global Bit Ventures has since reduced its stake by almost two-thirds. It said in disclosure filings that it held 2.3 million shares as of Dec. 27, and 1.1 million at the end of March.

MORE NEW SHARES

Marathon Patent said in its 10-K filing that it had three full-time employees at the end of 2018. It said it granted its executives and directors options last October to buy 1.36 million shares at an exercise price of $2.32 (both figures adjusted for last month’s reverse split).

Half vested immediately, with the other half vesting in two equal installments on the 6-month anniversary and the one-year anniversary of the grant. The 1 million options now vested could be exercised at a profit of 50 cents each as of last week.

Marathon Patent’s current chief executive, Merrick D. Okamoto, also is president of Viking Asset Management LLC. That California-based fund and its principals have a long history of investing in Honig-backed companies.

Marathon Patent gave Okamoto a two-year employment contract last October that included a base salary of $350,000 a year..

Marathon Patent’s chief financial officer, David P. Lieberman, also has invested alongside Honig in other companies. His employment contract includes a base salary of $180,000.

Both were recruited as directors of Marathon Patent around the same time as the company’s shift from patent licensing to bitcoin.

OTHER COMMON TIES

We reported last year that Marathon Patent’s transfer agent was Equity Stock Transfer LLC. It also is PolarityTE’s transfer agent, and was Riot Blockchain’s transfer agent for a special dividend that the company paid to shareholders – primarily Honig and his associates — in October 2017.

Equity Stock Transfer is headed by Mohit Bhansali. He was a director of PolarityTE’s predecessor, Majesco Entertainment Co., until March 2017, the month before the two companies completed their reverse merger.

Bhansali also was among the investors who bought shares and warrants in Riot Blockchain’s forerunner, Bioptix Inc., alongside Honig, Stetson and Groussman.

SEC filings show that Equity Stock Transfer has received operating funds from Paradox Capital Partners LLC. It is managed by Harvey Kesner, who was a partner in the law firm of Sichenzia Ross Ference Kesner LLP in New York.

Kesner and the firm acted as securities counsel to Marathon Patent, Riot Blockchain, PolarityTE, Mabvax, MGT Capital and BioZone, among others.

Paradox also was an investor in some of those companies. Kesner parted ways with the law firm last August, just before the SEC brought its case against Honig and his associates. The firm now is known as Sichenzia Ross Ference LLP.

Mabvax filed suit last year against Kesner and his former firm, alleging that they were complicit in some of the improper activities that the SEC alleged that Honig, O’Rourke, Stetson and others engaged in with respect to its shares.

Mabvax recently brought a second suit, against Honig and his associates.

Mabvax sought protection from creditors last month under Chapter 11 of the bankruptcy code. It said it would seek to use the process to sell substantially all of its assets.